Primary flood risk underwriting

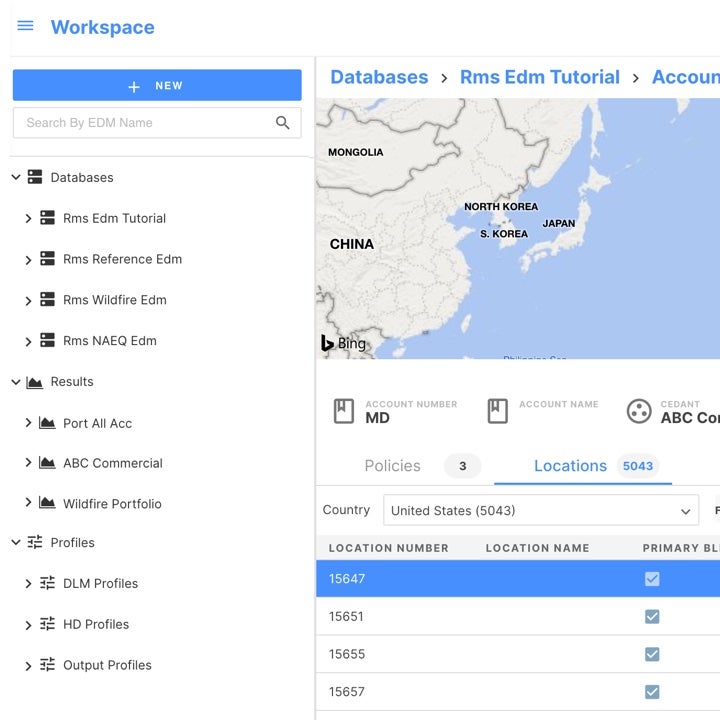

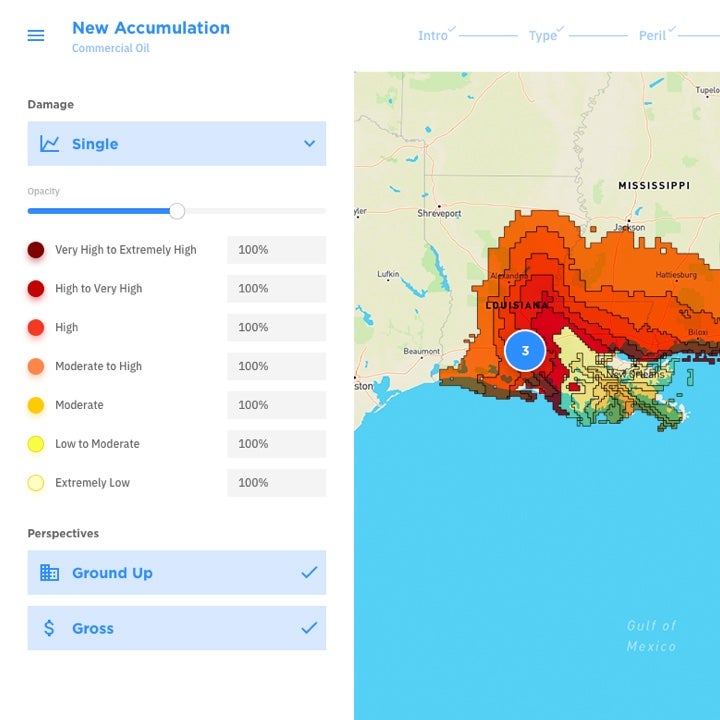

Our award-winning high-definition (HD) model framework enables modelers to explicitly capture the spatial and temporal correlations of flood risk as well as simulate losses at the location-coverage level, from the ground up, providing the most comprehensive representation of flood risk to help improve risk selection. Specialty add-ons are available for understanding the unique risk profiles of industrial facilities, buildings under construction, and marine cargo and specie across markets.