Realizing the benefits of cloud transformation

Risk trading decisions are complex. Often requiring teams to collaborate across different disciplines, regional and corporate departments, and lines of business using different views of risk based on different exposure data, modeling approaches, or analytical engines. Technology should help reduce this complexity, but most solutions focus on solving specific challenges for underwriting, catastrophe modeling, or portfolio management without accounting for how risk transfer decisions are made for a (re)insurer. Let’s dig into some of the common challenges arising from legacy systems and how cloud-native technology can help deliver greater value to your organization.

Asking the right questions

With the increased frequency and severity of catastrophe events, it has never been more challenging to achieve meaningful growth. Risk continues to grow in complexity, leaving insurers struggling to select the right technology to price risks more effectively, build a more diversified portfolio, and underwrite more business without compromising guidelines. Future-proofing your technology for the new world of risk starts with asking the right questions to help you reduce risk volatility, improve collaboration, and increase productivity. Our buyer's guides help you ask the tough questions to ensure that you’re getting the most out of your technology.

Innovative solutions for your biggest challenges

Exposure and portfolio management

Experience the future of portfolio management with ExposureIQ.

Learn more

Risk Modeling

Move risk management to the cloud for faster, easier risk insights with Risk Modeler.

Learn more

Intelligent Risk Platform

Accelerate your digital transformation journey with a comprehensive platform.

Learn more

Treaty analysis

Turn underwriting expertise into superior pricing and returns with TreatyIQ.

Learn more

Enhanced underwriting analytics

Automate underwriting workflows and analytics with UnderwriteIQ.

Learn more

Assess location risk in seconds

Reduce underwriting overhead and make informed decisions faster than ever.

Learn moreNews and insights

UnderwriteIQ: Improve Underwriting Profitability and Achie...

Within their role as the economic engine for insurers, underwriters face an increasingly challenging market to navigate through. With escalating natural catastrophe losses, rising inflation, and increasing customer expectations to contend with, this has all placed additional pressure on the underwriting organization. There is a need for underwriters to improve their risk selection and technical pricing, and to modernize their systems to support new digital workflows and advanced analytics capabilities. But d...

Modernize Treaty Risk Analytics with Moody’s RMS TreatyIQ

The 2023 1/1 property reinsurance renewals were the toughest and most prolonged for many years, with much of the negotiations pushed into the last couple of weeks. Many reinsurers adopted firmer positions on peril coverages and price across the board, evidenced by 37 percent rate increases according to Howden, with reduced market capital, concerns about creeping catastrophe concentrations, and the increasing cost of retrocession among the drivers of the caution. This renewal season required effecti...

Major Hurricane Ian: How Good Is Your Climate Risk Model?

As the need to understand climate risk grows ever more urgent, asset managers, lenders, corporates, and businesses all need to be confident that their climate risk models can capture the complexity of climate and weather events – in order to satisfy their regulators, boards, and shareholders. Moody’s Climate on Demand has led the way in the provision of climate risk analytics, and during 2023 this innovative solution will deliver new risk metrics that capture the financial impacts of climate risk by integrat...

Quantifying Financial Impact of Climate Risk with Moody’s ...

Climate change is widely accepted as the next great integrated risk challenge. To ensure long-term economic resilience, a wholly robust and comprehensive approach for estimating climate impacts will be required, one that captures real asset losses as well as distributive business interruptions. This requires a worldwide transformation in asset management strategies to help reduce climate risk exposure. The number of billion-dollar natural disasters has continued an upward trajectory in both frequency and sev...

Impact of Inconsistent Geocoding on Risk Transfer and Pric...

There is an expectation that an address within an insurance portfolio will represent a single distinct location, with only one possible set of coordinates. The deployment of different risk applications across the organization can result in an exposure’s location shifting, depending on the geocoding engine running in each risk application, from underwriting to catastrophe modeling or even exposure management. How does a single address end up with different geocoordinates in different applications? The address...

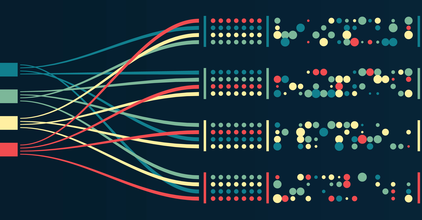

What Is a Risk Data Lake?

While the “data lake” has been around for some time, the term might still be unfamiliar to many. A data lake helps simplify analytics by bringing large, distinct sources of data together under one architecture to drive the extraction of new insights. Nowadays, many companies maintain more than one data lake – they might have one focusing on customer- or marketing-related insights, another focusing on security and compliance, product analytics, and so on. Recently, some vendors have been using the terms “lake...

The Insurance Talent Crunch: Smart Approaches Make a Bigge...

If you examine any business sector, the current battle for talent is fierce. Numerous factors are combining to make both recruitment and retention complex and challenging – starting with employee turnover. According to McKinsey & Company, 40 percent of the global workforce is looking to leave their current job in the next three to six months. The McKinsey article said the pandemic has caused employees to reevaluate everything from employment to overall life direction. It outlined three emerging employee ...

Breaking Down Data Silos with the RMS Unified Risk Analyti...

There’s no doubt that we now have more data and apps at our fingertips than ever before to help us make decisions. But for financial services, reinsurance, insurance, or brokerage companies, this often means you have to deal with multiple disconnected systems across the departments that are driving critical business decisions. For the insurance industry, at RMS® we sometimes see a decision-making center – such as underwriting, exposure management, risk analytics, cat modeling, or actuarial – use a system bui...

Five Challenges Insurers Face to Get an Enterprise-Level V...

For (re)insurers, getting an enterprise-level view of their exposure is essential. It sheds light across the entire book of business – identifying concentrations of risks, portfolio blind spots, and how losses flow through insurance and reinsurance portfolios – especially when an event strikes. With the time, effort, and resources required to produce an enterprise-level view of exposure, the overall result may be inaccurate, not reflect the entire business, or just be out of date. So, what are the five main c...

The Impact of Inconsistent Financial Modeling on Risk Pric...

Most (re)insurers rely on an assortment of tools from a variety of vendors to support various business functions and subsequent workflows. From risk selection, underwriting, and pricing through to event response, portfolio, and capital management – all have different data and analytics needs. However, one constant across all these functions is the need to capture and account for details within legal contracts. The risk ultimately held and managed by an insurer lies within the stacks of primary policies, facu...

Getting the Latest View of Risk Into the Business Faster

Risk modeling teams experience constant pressure to ensure their business uses the latest view of risk. In an ideal world, risk models across all perils and regions would be validated and incorporated into the business as soon as they become available. But in the real world, risk model validation is a long and intensive, but necessary process. Many model vendors including RMS® release an annual major model build as a single “all-or-nothing” on-premises software package.* A typical release will include many n...

RMS ExposureIQ: Award-Winning Application for Exposure Man...

On behalf of RMS®, I am delighted to accept the Risk Innovation of the Year award from InsuranceERM. What is so encouraging is that the judges recognized the significant innovation behind our exposure management application RMS ExposureIQ™, one of a range of applications available on the RMS Intelligent Risk Platform™. Support for Exposure Managers Exposure management is a function ripe for innovation. As a business, we took the time to fully understand the pressures that exposure managers face daily. ...

How Poor Data Fidelity Erodes Trust in Model Validation – ...

From client feedback, it is clear there is no one-size-fits-all approach to risk model validation and the associated processes involved to review new and updated third-party models, ready to be incorporated into a company-wide view of risk. And if you use your own IT environment, it’s a big task. A full model validation could take two to three cat modelers anywhere from three to six months to complete all required tasks to integrate a new model. What’s involved in validating models using your own IT environme...

How to Avoid the Hidden IT Costs of Risk Model Change Mana...

The change management process for a (re)insurer – with updating risk models and associated downstream workflows – is becoming increasingly complex, costly, and time-consuming. Running on the most up-to-date view of risk as provided by your model vendor, whether it is to gain a competitive advantage or responding to a regulatory requirement, makes change management unavoidable. Whether a (re)insurer uses an on-premises or software as a service (SaaS) solution, having the latest view of risk is a necessity to ...

Moody's RMS Intelligent Risk Platform™

Our vision is to make every risk known. Intelligent Risk Platform makes that future possible as the only collaborative applications and unified analytics cloud that can power risk management excellence across organizations and industries helping customers innovate and outperform.

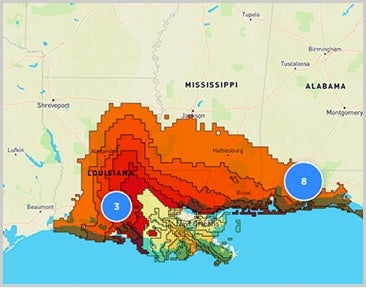

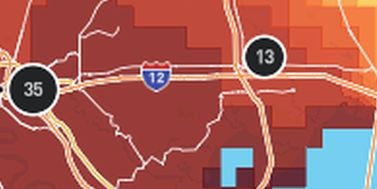

RMS HWind Hurricane Forecasting and Response and ExposureI...

Accessing data in real-time to assess and manage an insurance carrier’s potential liabilities from a loss event remains the holy grail for exposure management teams and is high on a business’ overall wish list A 2021 PwC Pulse Survey of U.S. risk management leaders found that risk executives are increasingly taking advantage of “tech solutions for real-time and automated processes, including dynamic risk monitoring (30 percent), new risk management tech solutions (25 percent), data analytics (24 percent) [and...

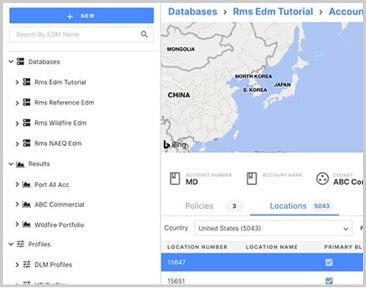

One Year On: Getting to Work With the Risk Modeler Applica...

Making the shift to cloud-based risk modeling and analytics sounds dramatic, a fundamental change for the (re)insurance industry from the familiar to a whole new world. But this whole new world is already here. From an RMS® perspective, some of our clients have been using the Risk Modeler™ 2.0 application on our open, cloud-based risk analytics platform RMS Risk Intelligence™ for over a year now. What has their experience been, what are they using the Risk Modeler application for, and from a client...

Latest ExposureIQ: Delivering the Future of Exposure Manag...

I recently saw a presentation by the U.K.’s Institute and Faculty of Actuaries (IFA) discussing a survey where 28 percent of respondents rated their current exposure management tools as poor; only 61 percent rated them adequate. The survey also recognized two vital aspects of exposure management. On one side, identifying and minimizing losses through daily portfolio management and timely quantification of potential cat event losses. On the other side, informing growth strategy and looking at opportuniti...

Risk Modeler: Bringing You Closer to One View of Risk

Analyzing recent insurance industry outlooks, such as the 2021 Insurance Outlook published by Deloitte just before the start of the year, a core theme emerges. The industry is looking to speed up its push towards digital transformation. From migration to the cloud to investment in data analytics, 95 percent of those surveyed were already accelerating or looking to speed up their digital transformation plans. One driver was to build operations resilience after COVID-19. Product innovation, addressing complianc...

The Future of Risk Management

(Re)insuring new and emerging risks requires data and, ideally, a historical loss record upon which to manage an exposure. But what does the future of risk management look like when so many of these exposures are intangible or unexpected? Sudden and dramatic breakdowns become more likely in a highly interconnected and increasingly polarized world, warns the “Global Risks Report 2019” from the World Economic Forum (WEF). “Firms should focus as much on risk response as on risk mitigation,” advises John Dr...

ExposureIQ Makes Understanding Loss Exposures Across Insur...

What if you had a tool that could give you a more complete view of how losses flow through your entire organization – across both insurance and reinsurance? Today I’m excited to share that we’ve made this possible – in our latest release of RMS ExposureIQ™, which select customers can preview for a limited time. Manage Insurance and Reinsurance Accumulations to provide “Net of Reinsurance” numbers Getting an accurate view of how losses flow through an organization – from an insurance portfolio to a reins...

Transform your business with risk analytics