Location Intelligence API delivers high-resolution, robust, and comprehensive data that can be directly integrated into existing systems. It harnesses terabytes of catastrophe simulation data to provide unmatched insights of individual properties in real time, so underwriters can make better and more informed risk decisions with location-specific attributes delivered in sub-second latency.

Unified Underwriting Solutions for P&C Insurers

Moody’s underwriting solutions deliver consistent and trusted data across lines of business to support decision-making from pre-bind quoting to portfolio steering. Built on cloud-native technology, each product delivers fast and power analytics that easily embed in new or existing workflows.

Large Commercial and Account Underwriting

Treaty Underwriting

Sustainable Underwriting

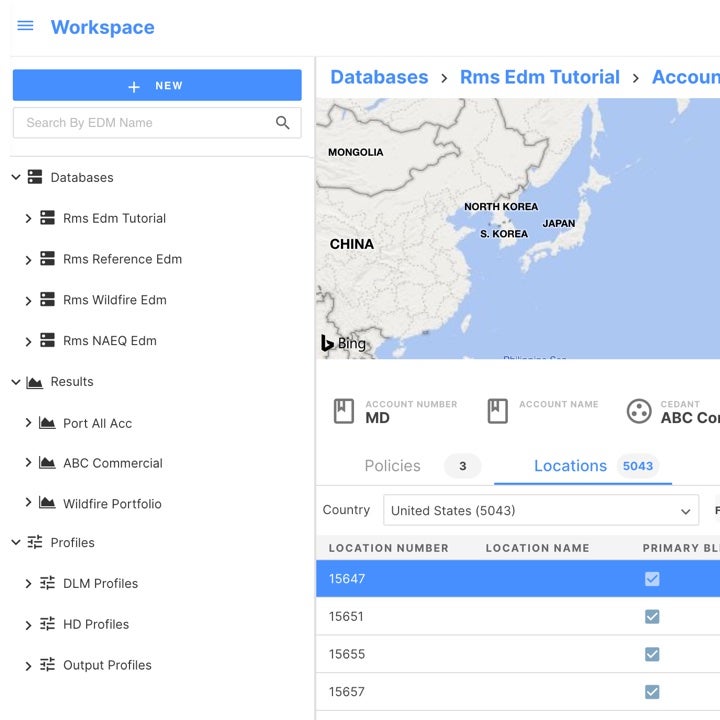

The UnderwriteIQ™ application empowers underwriters with robust Moody’s RMS hazard data and peril models for the analytics needed to enhance the speed and quality of underwriting decisions. This easy-to-use and highly configurable cloud-native application improves underwriting decision-making for cat-exposed business and complex risks.

The TreatyIQ™ application provides advanced treaty analytics and portfolio roll-up, unifying treaty underwriting and portfolio management within a single intuitive application. Model-agnostic insights on risk levels, profitability, marginal impact, and portfolio risk drivers deliver superior pricing, participation, and risk transfer decisions for property treaty reinsurers and brokers.

Our sustainable underwriting solution seamlessly embeds advanced environmental, social, and governance (ESG) factors into pre-bind and post-bind workflows. It unlocks new opportunities to engage with your insured clients, differentiate your product offerings, and proactively mitigate reputational risk. Available in the award-winning ExposureIQ™ application for exposure management, our sustainable underwriting analytics use the same exposure data and financial engine as the UnderwriteIQ application, TreatyIQ application, Risk Modeler™ software, and Location Intelligence API, so all your workflows are connected under a unified view of risk.

Customer Success Stories

Resources

Speed and Confidence: Make Better Underwriting Decisions w...

Residential and small commercial market insurers are facing continued pricing and coverage challenges. First, consumer demand for properties located in traditionally higher-risk areas has continued to rise, and with a changing risk landscape, inflation, and other factors, losses in these locations have also increased significantly. Second, the rise of on-demand, Internet-driven services with easy-to-use comparison sites, instant access to media sources, and same-day goods delivery, has seen consumer expe...

UnderwriteIQ: Unleash the Power of Marginal Impact Analysi...

I am excited to share that integrated marginal impact analysis is now available within the Moody's RMS UnderwriteIQ™ application. Marginal impact analysis helps insurers to identify higher-risk policyholders who may require revised premiums or additional risk management measures. By incorporating marginal impact analysis assessment, underwriters can more effectively allocate resources, minimize potential losses, and optimize profitability of their underwriting portfolios. One method of conduct...

Taking Stock After the Impact of 1/1 Renewals on Primary U...

Recent events have demonstrated that there has never been a more important time for insurers to reduce risk volatility and uncertainty in their risk decision-making processes. The market is still picking up the pieces after the 1/1 renewals, which were described by broker Howden as representing “... the biggest reinsurance capital squeeze since 2008,” and saw a capital erosion of US$66 billion and reinsurance rates accelerate by more than 45 percent. This has resulted in primary insurers paying much...

Five Challenges Impeding P&C Reinsurers from Making Inform...

For many property and casualty reinsurers, calculating treaty analytics can be a frustrating and time-consuming process, as antiquated tools and workflows put teams under significant pressure when attempting to deliver timely and accurate insights. And with an increased appetite for analytics together with a more condensed binding window, this year’s January 1 renewals exposed how inflexible some of those workflows can be. This inflexibility also resurfaces when analytics teams have to deal with the aftermat...

Related Products

Related Models

Earthquake

Get the most informed view of earthquake risk possible with comprehensive coverage of seismically active regions across five continents.

Cyber

Quantify both affirmative and silent cyber risk to take advantage of market opportunity with the Moody's RMS probabilistic cyber catastrophe risk model.

Flood

Access broad-scale, well-validated views of flood risk to gain necessary insights into the range of commercial opportunities associated with various flood markets.

Terrorism

Make better risk-based decisions with loss metrics for property and workers’ compensation lines using industry-leading terrorism models.

Japan Typhoon and Flood HD Model

Gain a greater understanding of typhoon and flood risk using Moody's RMS Japan Typhoon and Flood model.

Wildfire

Leverage unprecedented detail on loss outcome ranges for U.S. locations or portfolios to better manage and price wildfire risk.

North Atlantic Hurricane

Manage key drivers of tropical cyclone risk across 40 countries.

Want to Underwrite With Confidence?