Implement a Solution

Whether you are starting a risk modeling operation or have deep, well-established resources, our consultants advise and help implement best practices across your catastrophe management operations. Our aim is to help companies optimize their investment in Moody's insurance solutions technology, accelerate "time to value," and minimize implementation risk.

We provide analysis and guidance on the best use of Moody's data, models, and technology, including:

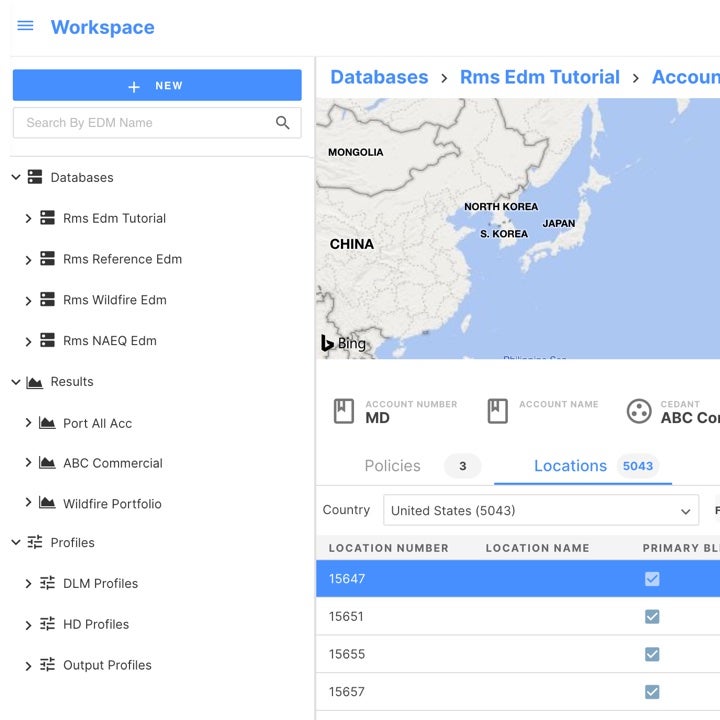

- Workflow automation and system integration

- Custom technology solutions for unique use cases

- Software deployment and configuration

- Adoption assurance services to ease the transition to new software and workflows