Global Reach and Local Support

As the North American market continues to develop, Moody's insurance solutions delivers a vision of risk built on modern science, data, and lessons learned about global events.

Continuing Regional Investment

Moody's has released and updated a variety of regional offerings in recent years, such as flood and wildfire, to help (re)insurers manage their risk strategy for the region.

Innovative Offerings

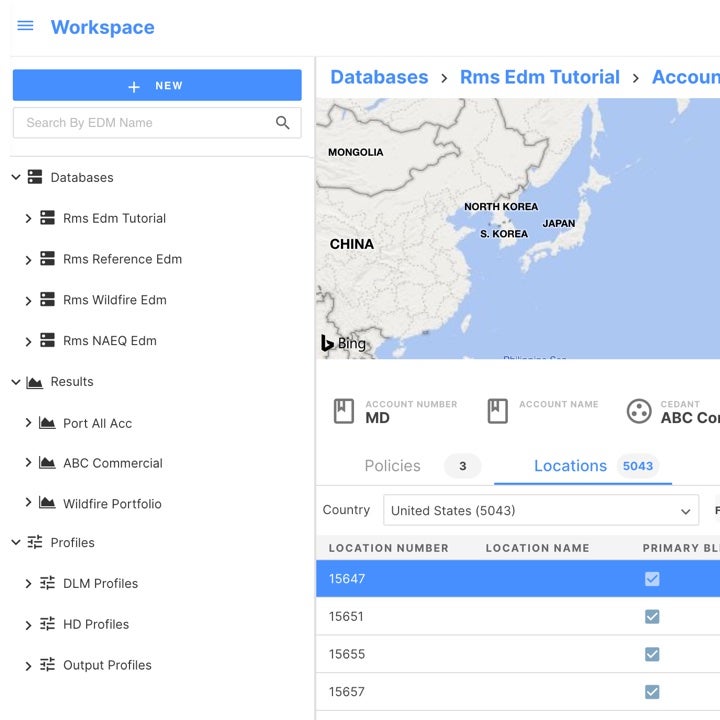

Through Moody's RMS Intelligent Risk Platform™ there are a variety of applications available to help you manage your risk strategy.

Focused Solutions

Moody's insurance solutions offers market-focused solutions for wildfire, flood, earthquake, tropical cyclones, and more across North America.

North America Model Coverage

Builders Risk

- Mexico

- United States

Earthquake

- Canada

- Mexico

- United States

Hurricane

- Canada

- Mexico

- United States

HWind

- Canada

- Mexico

- United States

Industrial Facilities

- Canada

- Mexico

- United States

Inland Flood

- United States

LifeRisks - Infectious Disease

- Canada

- Mexico

- United States

LifeRisks - Longevity, Excess Mortality

- Canada

- United States

Marine Cargo & Specie

- Canada

- Mexico

- United States

Offshore Platform

- United States

Probabilistic Terrorism Model

- Canada

- United States

Severe Convective Storm

- Canada

- United States

Wildfire

- United States

Winterstorm

- Canada

- United States

Workers’ Compensation

- United States

Related Products

Spotlight

How Moody's insurance solutions is raising the bar in catastrophe modeling

In order to help our customers outperform their competition, Moody's is on a continuous quest to build high-quality models using the best available data, science, people, and technology. For more than 30 years, that has been a specialty of Moody's RMS. Our approach makes all the difference.

Learn about catastrophe modeling and the latest advances in Modeling.

Wildfire Risk: Quantifying the Impact of Mitigation Measures in the Power Sector

In partnership with SCE, Moody’s utilized our North America Wildfire HD Model to assess where potential losses were most likely to be triggered and measure the impact of wildfire mitigation.

Global Model Coverage

Moody's has over 200 peril models in nearly 100 countries enabling organizations to quantify the potential magnitude and probability of economic loss from catastrophe events.

Getting Ahead of the Curve on Data Quality

Incomplete or inaccurate data assessment can bias model results. In our latest Illustrate case study, we look at how Moody's insurance solutions worked with Securis to enhance the quality of its cedant-provided data.

Resources

Rare but Not Unprecedented: Nicole Threatens Florida as a ...

With just over three weeks to go until the official end of the 2022 North Atlantic Hurricane season, Subtropical Storm Nicole – the fourteenth named storm of the year, could be a rarely seen event – a hurricane in November making landfall on Florida’s east coast. Attaining subtropical storm status on Monday, November 7, Nicole is a large storm with tropical-storm-force winds currently extending up to 380 miles (610 kilometers) from the center of the system. Nicole is expected to transition into a tropical sto...

North American Wildfires: Fighting Back with Mitigation

The wildfire season has already been intense, with over 15,000 structures either damaged or destroyed in Western U.S. wildfires and over four million acres burned in the recent wildfires across Northern California, Oregon, and Washington State. From recent RMS® industry loss estimates, insured losses for these events are in the range of US$6-US$10 billion. There have sadly been 31 confirmed fatalities in California from the recent fires. Seeing images from communities that have suffered both recently and in p...

Three is a Magic Number: RMS Wins Risk Modeling Company of...

Many RMS colleagues attended the recent Reactions North America Awards 2020, admirably hosted by Shawn Moynihan, the magazine’s Editor-in-Chief. The virtual awards ceremony was a great opportunity for the industry to come together and celebrate exceptional achievement in what has certainly been an unusual year. And on behalf of RMS®, I am delighted to receive the Reactions North America 2020 Award for “Risk Modeling Company of the Year.” I know that to win this award you need support from both the independent ju...

U.S. Flood: Why Is Flood Insurance Take-Up So Low?

Surveys suggest that 91 percent of American homeowners purchase insurance, but when it comes to flood risk the story could not be more different. Flooding is not covered in standard homeowner or renter policies, and the take-up of flood-specific coverage for homeowners is estimated to be around 15 percent – even though flood is a prevalent, nationwide peril. In the last decade, 98 percent of U.S. counties have been affected by flooding. According to the National Flood Insurance Program (NFIP), about 90 percent o...

North Atlantic Hurricane Season Halftime Report: Will the ...

Now that we have passed the halfway point of the 2020 North Atlantic hurricane season, it feels like a good opportunity to take stock and look ahead to what the remainder of the season might have in store. Record-Breaking Start to the 2020 Hurricane Season The 2020 season has already made its mark in terms of the number of storms that have formed and how early they formed. For the very latest event summaries, visit the RMS Event Response web page. This was further demonstrated on September 14 when, for onl...

Need Help Managing Risk in North America?