About Moody’s insurance solutions

Moody’s RMS has shaped the world’s view of risk for over 30 years, leading the catastrophe risk industry that we helped to pioneer. In 2021, we became a part of the Moody’s family to accelerate the development of our joint integrated risk capabilities on a global scale, ensuring we are equipped to tackle the challenges of tomorrow's risk landscape.

Aerial view of road through Danxia landform, Xinjiang, China

Moody’s insurance solutions story

Moody’s insurance solutions is transforming the catastrophe risk industry, helping organizations make better decisions to improve human and environmental outcomes. By combining proven modeling science and applications we empower customers to manage their risk and reduce uncertainty through access to applications that integrate our proven model science and robust data solutions on the Moody’s Intelligent Risk Platform™, the industry’s first risk platform.

In the past, managing risk was the realm of insurance companies. Today, it has become an important undertaking across industries and geographies, and we continuously advance this effort. Extreme weather, climate change, and other catastrophes impact all of us. Understanding risk, integrating analytics, and sharing expertise more broadly are how we’re contributing to building a more resilient world.

2023 By the numbers

1st Place

in Chartis RiskTech 100

250

Customers

Active on the Intelligent Risk Platform

1 Bn

Locations Accumulated

in less than 4 hours

5 Bn

Locations/Risks

Modeled per month on the Intelligent Risk Platform

56 Releases

for Intelligent Risk Platform Applications

140

Catastrophes

Analyzed by Event Response Services

10 New

Workflows

Unlocked on the Intelligent Risk Platform

200+>

Customers

Using Moody's solutions to perform IFRS17 reporting

143 Models

Released across the globe

1st

Data-Driven Underwriting

Data integrated into cloud-native applications

70%

Risk Modeler

Clients are subscribing to HD models

10,000+

Users

of Moody's Actuarial software worldwide

8

of the Top

10

Reinsurance brokers choose Moody's

10

of the Top

10

Insurers of Commercial Lines choose Moody’s

28

of the Top

30

Reinsurers choose Moody's

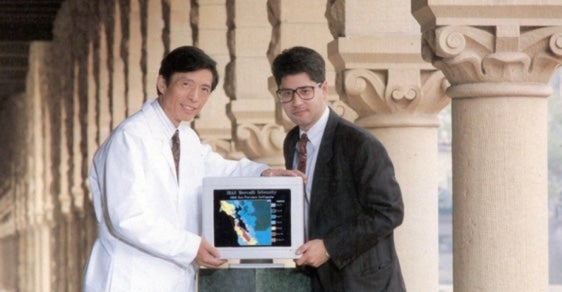

An insightful history

From our start at Stanford University to our worldwide reach and perspectives today, Moody's RMS has a long history of turning global needs into meaningful real-world insights. Our work has helped companies, governments, and other organizations foster greater resilience decade after decade.

2024

Moody’s RMS Intelligent Risk Platform™ (IRP)

As of January 2024, and within one year, Moody's RMS has more than doubled the number of customers using the Intelligent Risk Platform, surpassing 250 customers.

2023

Moody’s RMS Launches Cyber Industry Steering Group

Moody’s RMS, has announced the launch of Moody’s RMS Cyber Industry Steering Group to develop industry initiatives that respond to the growth of the global cyber insurance market.

2023

Moody’s RMS to Enhance Intelligent Risk Platform by Integrating Nasdaq Risk Modelling Platform for Oasis Based Models

Moody's RMS integrates Nasdaq’s (Nasdaq: NDAQ) Risk Modelling for Catastrophes (NRMC) service into its Intelligent Risk Platform™.

2023

Moody’s RMS Risk Labs

Moody’s RMS Risk Labs is our innovation center, a place where technology experts, software engineers, insurance industry professionals, and our customers come together to preview and discuss new risk innovations and prototypes.

2023

Climate on Demand

Climate on Demand provides foundational insight through rigorous data and analytics that define current and forward-looking location-specific threats to real assets from climate-related event damages and business disruption.

2022

Moody’s RMS Advances Climate Risk Modeling and Moves More Models to High Definition

Moody's RMS announces it will be releasing four new High Definition™ (HD) models, including Europe Windstorm, North America Winterstorm (WT), North America Severe Convective Storm (SCS), and Terrorism.

2022

RMS Appoints Michael Steel as General Manager

Moody's RMS announced that Michael Steel has been appointed to its top leadership position of General Manager. Steel succeeds Karen White, who has recently stepped down following the completion of the Moody’s acquisition.

2021

Moody's Acquires RMS

Moody’s acquired RMS September 15, 2021 to accelerate the development of the Company’s global integrated risk capabilities to address the next generation of risk assessment.

2021

New Climate Change Models.

RMS launches Climate Change Models to help customers assess the near and long term impacts of climate change on physical assets and their businesses.

2020

Risk Modeler 2.0

Launched in July, Risk Modeler 2.0 is the leading next-generation Risk Management solution. It’s what cloud-native really means: economies of scale, elasticity, ease of deployments, and security.

2020

Risk Data Open Standard

RMS introduced the Risk Data Open Standard (RDOS), a modern data schema for the risk modeling community, for open-source development.

2019

New Solutions for New Needs

When the 2018 Camp and Woolsey Fires unleashed unprecedented destruction in California, the impact of climate change was clear. The RMS US Wildfire HD model released in 2019 integrated this intelligence for more actionable insights.

2019

Two Powerful Data Solutions

RMS introduced Location Intelligence API, giving underwriters big data simulations of catastrophe events, and SiteIQ™, enabling a deeper understanding of all hazards facing any property.

2017

Hurricane, Flood, and Fire

For Hurricane Harvey (category 4 storm – Houston) and Hurricane Maria (cat-5 – Puerto Rico), the RMS Event Response Team provided detailed flood estimate maps using our US Flood model. This same year, Napa and Sonoma wildfires led to record losses… until being surpassed in 2018.

2015

First Cyber Risk Model

With cyber risk being named a new top-five catastrophe risk, the company released its first cyber risk model.

2011

Growing Model Importance

Following the Tohuku Earthquake Tsunami (Japan) and increased focus on natural catastrophe risk, RMS released its RiskLink Version 11 North Atlantic Hurricane model, a major update incorporating 20 years of events and $18 billion in claims data.

2007

Climate Change Focus

RMS CRO Robert Muir-Wood was contributing author of the IPCC Fourth Assessment Report. IPCC and Al Gore won the Nobel Peace Prize, drawing international attention to climate change. RMS expanded its focus on climate change and its effect on the frequency/severity of modeled events.

2005

Cat Modeling Certification

RMS created the first training program and certification specific to cat modeling, the Certified Catastrophe Risk Analyst (CCRA®). The designation has gained insurance industry recognition as a symbol of excellence in the field of catastrophe modeling.

2003

First Terrorism Model

In response to the events of 9/11, RMS released its first terrorism model. The company also provided risk analysis for the first-ever terrorism catastrophe bond issued by FIFA to cover the risk of a 2006 World Cup cancellation.

2001

Terrorism Risk

The September 11, 2001, attacks on the World Trade Center and the Pentagon, combined with growing threats to other targets, fundamentally changed our world and brought the risks of terrorism to the forefront. Scientists at RMS got straight to work.

2000

IRAS > RiskLink

With the initial release of RiskLink® DLM (Detailed Loss Module), the company shifted to a new platform for its modeling and retired the original IRAS software. Modeling was now a standard practice for the insurance industry.

1998

A New Owner

Risk Management Solutions (RMS) was acquired by Daily Mail and General Trust (DMGT), a British media company. By this time, RMS models covered 40 territories. The company also released RiskLink® ALM (Aggregate Loss Module), our first modeling software.

1995

International Expansion

IRAS Version 3.2 expanded coverage with six earthquake models (AUS, CHL, GU, JAM, JPN, NZL), three typhoon models (AUS, GU, JPN), two severe convective storm models (USA, CAN), and a fire-following earthquake model (USA).

1994

New Company Name

Risk Management Software, Inc. becomes Risk Management Solutions, Inc. to better reflect its expansion into risk modeling solutions and services.

1993

First Hurricane Model

With the release of IRAS Version 3.0, RMS offered its first hurricane model (and first Windows product). This version also included U.S. earthquake models. See also hurricane and earthquake models.

1992

Hurricane Andrew

Hurricane Andrew, a Category 5 storm that struck the Bahamas, Florida, and Louisiana, was the most destructive and costliest hurricane at the time. It caused the bankruptcy of 24 insurers and made catastrophe modeling a business-critical investment.

1989

RMS Earthquake Model

With the Loma Prieta Earthquake occurring the same year that RMS was founded, demand for earthquake insurance was growing. The company’s first model – IRAS 1.0 for California Earthquake – was in high demand.

1989

RMS Founded

The Insurance and Investment Risk Assessment System (IRAS) was developed at Stanford by Hemant Shah and Weimin Dong in 1988 as a research project funded by insurers. In 1989, the project was spun off to form Risk Management Software, Inc.

Meet the leadership team

Each member of our executive team adds a unique perspective and proven experience to help us deliver high-resolution risk insights to industries affected by the uncertainty of natural and man-made catastrophes. Together, they foster a company culture dedicated to making a difference.

Colin Holmes

General Manager, Insurance Solutions

Michael Steel

General Manager and Head of Insurance Solutions

Cihan Biyikoglu

Managing Director, Product

Moe Khosravy

Managing Director and Head of Engineering

Alok Kumar

Managing Director India and Head of Global Analytical Services

Robert Muir-Wood, PhD

Chief Research Officer

Mitch Parker

Global Head of Customer Success

Jill Powell

Global Head of People

Mohsen Rahnama, PhD

Managing Director and Head of RMS Modeling and Data

Michael Richitelli

Managing Director and Global Head of Sales

Diya Sawhny

Head of Strategy and Marketing

Careers at Moody's

Join our team of leading scientists, developers, industry experts, and world-class professionals. Together, we’re creating a more resilient world through a better understanding of catastrophic events.

Make resilience part of your mission