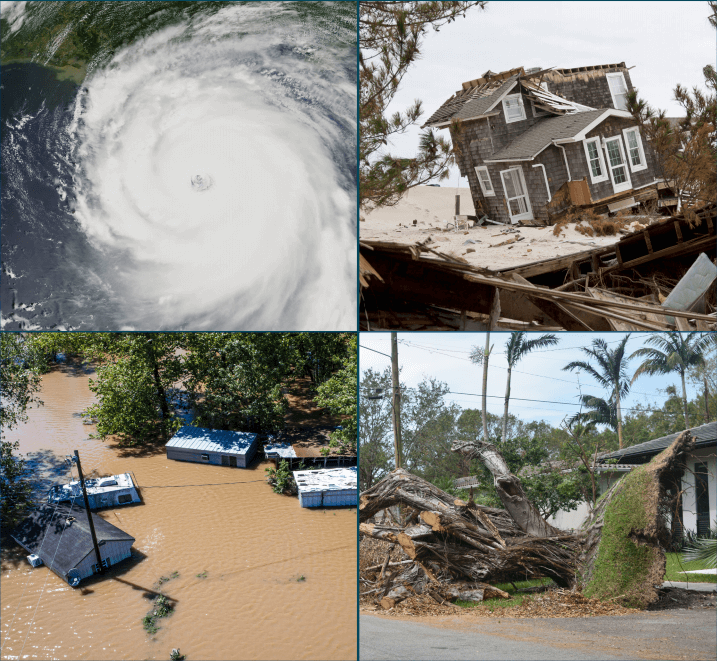

Make sense of complexity

Our U.S. flood model considers complex hydrodynamics, multiple hazard sources, steep gradients, flood defense impacts, and individual building vulnerability to understand tail risk, adequately price, manage to defined risk tolerances, and help you implement a profitable flood strategy.

Complete risk outlook

Access a complete characterization of flood events built on 50,000 simulation years to inform confident capital allocation, solvency assessments, and pricing.

Measurable sensitivities

Quantify impacts of mitigation efforts and failures with defended and undefended views of flood risk for appropriate risk selection, underwriting, and portfolio management.

Accurate risk differentiation

Capture critical exposure characteristics, including first floor height, to reflect each property’s unique vulnerability to flood and improve risk differentiation.

A Comprehensive Flood Solution

Proper flood modeling captures flood hazard from all sources and translates it to damage and financial costs, while accounting for complex policy terms.

Industry leadership

Related products

Learn more

Powerful U.S. flood insights

Risk Modeler from Moody's now incorporates the U.S. Inland Flood HD model, as Risk Modeler has several features to quickly surface insights into the model and ultimately allow users to make business decisions faster.

Horizons

This edition includes articles across a range of important topics for the cat risk market and has two focused sections on our new high-definition (HD) models for U.S. wildfire and for U.S. inland flood.

Protection gap

Moody's RMS modeling reveals the wider risk of U.S. flooding, and a significant protection gap

Resources

The Age of Innocence

Professor Ilan Noy holds a unique ”Chair in the Economics of Disasters” at the Victoria University of Wellington, New Zealand. He has proposed in a couple of research papers that instead of counting disaster deaths and economic costs, we should report the “expected life-years” lost, not only for human casualties but also for the life-years of work that will be required to repair all the damage to buildings and infrastructure. The idea is based on the World Health Organization’s Disability Adjusted Life Y...

Investing in Flood Risk Management and Defenses

Learn more about the financial benefits of flood defenses

Private Flood Insurers Not Yet Ready to Fill Massive U.S. ...

The flood insurance protection gap in the United States is massive, but the take-up rate of private flood insurance continues to be low.

Lessons from Hurricane Ida: How Catastrophe Modeling Can H...

Flood remains the most underinsured climate risk in the U.S. Consulting firm Milliman estimates that just 4 percent of U.S. homeowners have flood insurance coverage, which is primarily provided by the National Flood Insurance Program (NFIP). With 4.88 million policies, the NFIP provides around US$1.3 trillion in flood coverage. This low flood insurance protection rate is not a surprise, despite the emergence of analytical tools to quantify flood risk and a growing number of companies offering private flood c...

Moody's can provide the tools to help manage your flood risk