One platform for Unified Risk Analytics

Bringing together our excellence in science, modeling, and beyond.

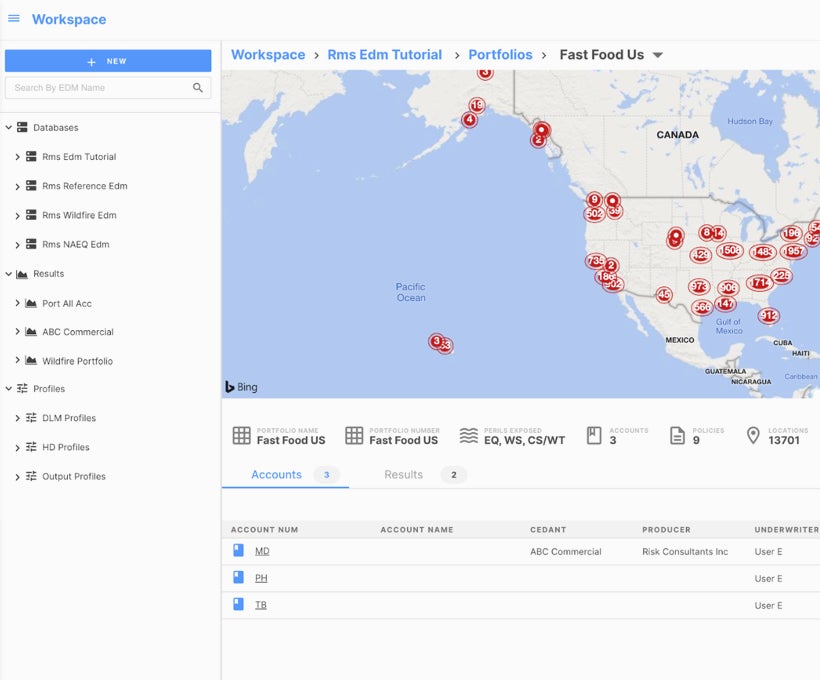

Access consistent and trusted data

Ensure everyone – from portfolio managers to modelers and underwriters – agrees on the same risk data with a single source of truth.

Collaborate with connected applications

Remove manual steps using our shared applications – such as Risk Modeler™ and ExposureIQ™ – on top of the platform.

Unify your view of risk

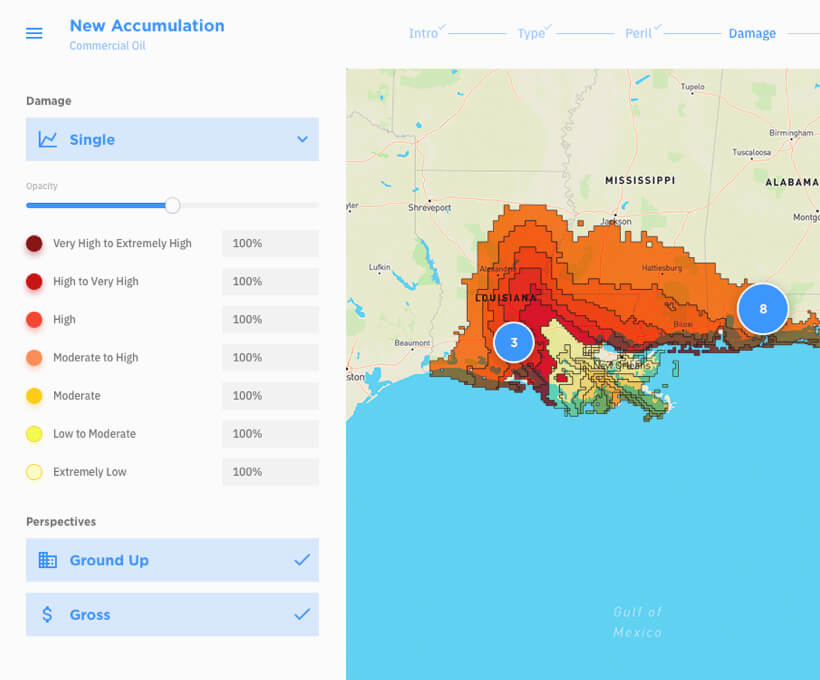

Break down silos and bring greater clarity to your underlying risks. Run precise, real-time accumulations across everything.

Collaborative applications across the insurance lifecycle

The integrated suite of applications empower risk-focused users with powerful analytics and modern risk management tools. Built on the Intelligent Risk Platform, our powerful, cloud-native applications are designed for multiple users to help them gain insights into potential hazards, exposures, and accumulations. Shared geocoding and financial engines, consistent modeling, and common exposure data are just a few innovations to help you to build a unified view of risk and improve decision-making.

Risk Modeler

Leverage structure-based modeling and analytical tools, including intelligent model processing and big data query capabilities.

Learn more

ExposureIQ

Manage your entire book of business more efficiently and accurately than ever before with this purpose-built solution for analyzing exposure concentrations.

Learn more

Location Intelligence API

Gain better underwriting perspective with instant access to the world’s best catastrophe insights.

Learn more

Risk Data Open Standard

Drive value and innovation from this new open standard, a modern data schema for risk analytics.

Learn more

TreatyIQ

Achieve your target portfolio by utilizing the advanced, customizable pricing and portfolio roll-up analytics direct to the property catastrophe underwriter.

Learn more

Cloud risk analytics: Buyer's guide

Moody's applications built on the Intelligent Risk Platform deliver performance and scale without the hardware and software maintenance required for on-premises offerings. Superior advanced analytics are readily available through one holistic enterprise risk management system.

Choosing the risk platform that fits your unique needs can be challenging. The Moody's Cloud Risk Analytics Buyer’s Guide can help you ask the tough questions so that you can realize the full value of your data, generate new insights, and reduce risk volatility.

Spotlight

Resources

Manual Data Processes Sapping Productivity? Data Automatio...

The property and casualty insurance industry has seen an explosion both in the amount of data and in the accompanying number of applications that generate and utilize this data. The use of data analytics to make informed risk management decisions has also increased as data flows grow in volume and variety. As business leaders demand timely insights from analytics, the need to collect and process data faster has grown. With this paradigm shift in data usage, data mobility has become a progressively larger cha...

Latest ExposureIQ: Delivering the Future of Exposure Manag...

I recently saw a presentation by the U.K.’s Institute and Faculty of Actuaries (IFA) discussing a survey where 28 percent of respondents rated their current exposure management tools as poor; only 61 percent rated them adequate. The survey also recognized two vital aspects of exposure management. On one side, identifying and minimizing losses through daily portfolio management and timely quantification of potential cat event losses. On the other side, informing growth strategy and looking at opportuniti...

RiskLink® and RiskBrowser® Version 21: A Seamless Transiti...

It has been a year since I took to the (virtual) stage at Exceedance® 2020 to explain our commitment to support all customers’ access to RMS® models, both on-premises and in our cloud platform Risk Intelligence™. Version 21 (V21), our major annual release for RMS RiskLink® and RiskBrowser®, includes updates to the RMS North Atlantic Hurricane Models and the general availability of the new RMS® China Inland Flood Model. In addition, V21 will include several platform updates to industry exposure databases for mult...

Risk Modeler: Bringing You Closer to One View of Risk

Analyzing recent insurance industry outlooks, such as the 2021 Insurance Outlook published by Deloitte just before the start of the year, a core theme emerges. The industry is looking to speed up its push towards digital transformation. From migration to the cloud to investment in data analytics, 95 percent of those surveyed were already accelerating or looking to speed up their digital transformation plans. One driver was to build operations resilience after COVID-19. Product innovation, addressing complianc...

RMS Unveils Significant New Event Response Innovations in ...

NEWARK, CA – May 6, 2021 – RMS®, the world’s leading catastrophe risk modeling and solutions company, announced new innovations to ExposureIQ™ on the Risk Intelligence platform, including real-time catastrophe event visualizations and more powerful reporting. RMS also unveiled new capabilities to allow cross-portfolio accumulations across reinsurance and insurance workflows. ExposureIQ is an innovative, cloud-based exposure management application designed to help portfolio managers gain deeper insights into ...

RMS Builds on Its Risk Modeler Cloud-Based Application

NEWARK, CA – May 7, 2021 – At its annual Exceedance conference this week, RMS®, the world’s leading catastrophe risk solutions company, demonstrated the benefits (re)insurance customers are experiencing by moving to RMS Risk Modeler™, the cloud-based risk modeling application running on the RMS open cloud platform, Risk Intelligence™. Risk Modeler, a next-generation cloud-based modeling application, is designed to meet the complex needs of risk analysts and cat modelers at scale. Risk Modeler enables real-ti...

Learn how Moody's can help you outperform