The Moody’s geocoding engine is tailored to the unique needs of insurers and their exposure data. Location Intelligence API leverages the same geocoding science used across all Moody’s applications. This means underwriters have access to a more consistent view of risk and can avoid minor location discrepancies that could trigger major shifts and potentially distort a property’s risk profile.

Underwrite with speed and confidence

Location Intelligence API enhances underwriting workflows for residential and small commercial insurers by integrating hazard, exposure, geospatial, and loss data from Moody’s Intelligent Risk Platform™. This tool provides vital insights that streamline risk management and promote effective risk assessment.

Modernize underwriting workflows

Support high-volume business with highly granular hazard and exposure data available via API.

Accelerate underwriting decision-making

Rigorously analyze pre-bind risk using best-in-class modeling science delivered with sub-second latency.

Unify risk analytics across stakeholders

Apply a common set of analytics that delivers greater consistency between underwriting and portfolio steering.

Your guide to location intelligence data

Location Intelligence API delivers more than 100 data layers across multiple kinds of data: hazard, location, risk score, model, and exposure data. These insights play a critical role to help understand and manage risks and offer granular, location-specific attributes about potential hazards, exposures, and their associated costs.

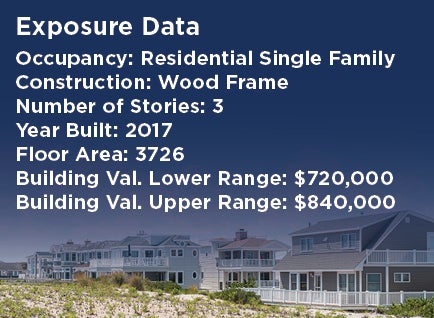

Exposure Data

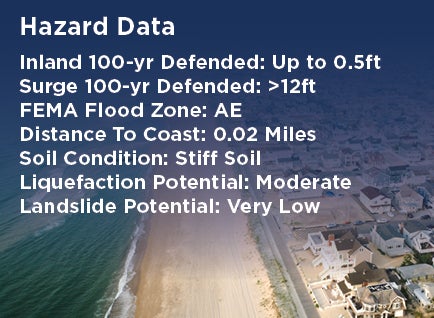

Hazard Data

Risk Scores

Loss Costs

Robust exposure data empowers insurance underwriters with detailed property characteristics. Location Intelligence API includes data for more than 100 million residential and commercial U.S. properties, so insurers can pre-fill exposure to facilitate “no questions asked,” augment existing exposure, or validate existing data. Underwriters can seamlessly integrate granular exposure data available via API to enable accurate risk pricing and reduce underwriting errors, promoting efficient decision-making.

Deep hazard insights enable insurance underwriters to implement knock-out screening through better understanding of the potential risks that can impact a location. Location Intelligence API delivers real-time hazard insights from Moody’s RMS catastrophe models to automate and speed up location processing with no manual intervention. This data-driven approach promotes efficient underwriting, optimized portfolio risk management, and a competitive edge in the market.

Moody’s Risk Scores, accessible via Location Intelligence API, distill complex catastrophe model analytics into a simple and easy-to-use score between 1 and 10 that streamlines risk selection and expedites decision-making. Underpinned by big data and catastrophe simulation, Risk Scores account for the vulnerability of user-defined building stock to illuminate potential exposure and enable proactive risk mitigation. This comprehensive, data-driven approach facilitates effective risk management, improving profitability and competitiveness in the residential and small commercial insurance market.

Only Location Intelligence API provides loss cost data for individual properties, equipping insurance underwriters with the same analytics used by the catastrophe modeling team. This data expedites risk-based pricing by providing location-specific estimates of average annual losses . Moody’s Loss Costs enable consistency from underwriting to portfolio management, resulting in reduced volatility, greater control, and improved predictability.

Customer success

Learn how Hiscox improved its underwriting performance and delivered strong growth using Location Intelligence API.

Previously, it would take months to roll out pricing changes. Now we can do it almost instantly.

Paul Butler, Partner and Chief Technology Officer, Hiscox

Quality data is table stakes for profitable underwriting

There is still an insufficient amount of data being gathered to enable the accurate assessment and pricing of risks [that] our industry has been covering for decades.

Talbir Bains

Founder and CEO, Volante Global

Why customers choose Location Intelligence API

Location Intelligence API delivers key data and insights to help you improve business decisions and better manage risk.

Resources

Major Hurricane Idalia: Risk Pricing Needs to Reflect Prop...

Hurricane Idalia made landfall as a Category 3 hurricane on August 30, 2023, near Keaton Beach, Florida, bringing with it damaging winds, heavy rainfall, and a devastating storm surge. Now with Idalia, this is the fourth consecutive year that a major (Category 3 or greater) hurricane has made landfall in the U.S., and it was also the first major hurricane to directly impact Florida’s Big Bend region in over 125 years. Moody’s RMS issued a private insurance market loss estimate for Idalia, estimating a US...

Democratizing Risk Data: How to Help Your Frontline Underw...

Underwriters are on the front line of insurance; they make the go/no-go decisions on whether new risks will arrive in the portfolio. Given the importance of their role as gatekeepers to new business, underwriting teams need the best available risk data for each property to empower them to make informed decisions. Downstream functions, such as portfolio managers and reinsurance purchasers through to brokers, have become accustomed to utilizing the best risk data that catastrophe modeling can offer, whereas underw...

Is It Time to Break up With Your Deficient Risk Scoring An...

Risk scoring is a fundamental part of the property and casualty underwriting process, allowing underwriters to sort and rank the quality of submissions. This process culminates in critical business decisions on quoting, declination, referral, and pricing, which taken together can make the difference between an insurer’s survival and its failure. The best insurers make these decisions in a manner that is disciplined, consistent, and data-driven. Those who fail to do this fall prey to adverse selection, ...

Speed and Confidence: Make Better Underwriting Decisions w...

Residential and small commercial market insurers are facing continued pricing and coverage challenges. First, consumer demand for properties located in traditionally higher-risk areas has continued to rise, and with a changing risk landscape, inflation, and other factors, losses in these locations have also increased significantly. Second, the rise of on-demand, Internet-driven services with easy-to-use comparison sites, instant access to media sources, and same-day goods delivery, has seen consumer expe...

New RMS Data Solutions Deliver Real-Time, Site-Specific In...

NEWARK, CA – June 28, 2019 – RMS®, a leading global risk modeling and analytics firm, announced the availability of two transformative data solutions hosted on RMS Risk Intelligence (RI), its strategic risk platform. Expanding on its suite of strategic risk products, these solutions employ sophisticated RMS models and rich data layers built into the RMS platform. With growing pressure to make critical underwriting decisions quickly, speed and precision is everything. RMS Location Intelligence API and the SiteIQ ...

Location Intelligence API

To survive in today’s competitive market, unyielding underwriting discipline is vital. Improper pricing assumptions, inappropriate declinations, and misalignment between underwriting and portfolio management can instantly erode underwriting margins. Underwriting discipline requires data-driven decisions that utilize the market’s most accurate risk indicators – provided by the RMS® Location Intelligence API.

Learn more about Location Intelligence API