Unify risk analytics across your modeling solutions

When risk analytics are managed independently – without considering the interdependencies or correlations between models, perils, and lines of business – building a comprehensive view of risk quickly becomes a daunting challenge. A single, unified experience to manage your Moody's, third-party vendor, and in-house models provides tremendous value to (re)insurance firms and brokers of all sizes and lines of business.

Focus on the art and science of risk

Craft your own view of risk by analyzing, blending, and grouping results from over 700 models from multiple vendors.

Unlock risk modeling productivity

Accelerate time to insights by leveraging powerful cloud-native environment and familiar tools.

Transact more efficiently with risk

Expand access to the reinsurance marketplace by effortlessly transforming exposure and results data into a standardized currency.

Why third-party modeling on the Intelligent Risk Platform

Modeling on the Intelligent Risk Platform delivers benefits that no other technology provider can offer. Built on a cloud-native platform, customers choose to partner with Moody's because we deliver a more unified experience for their organization.

Collaborative applications across the insurance lifecycle

Built on the Intelligent Risk Platform, our powerful, open cloud-native applications are designed for multiple users to help them gain insights into potential hazards, exposures, and accumulations. Shared geocoding and financial engines, consistent modeling, and common exposure data are just a few innovations to help you to build a unified view of risk and improve decision-making.

Risk Modeler

Leverage structure-based modeling and analytical tools, including intelligent model processing and big data query capabilities.

Learn more

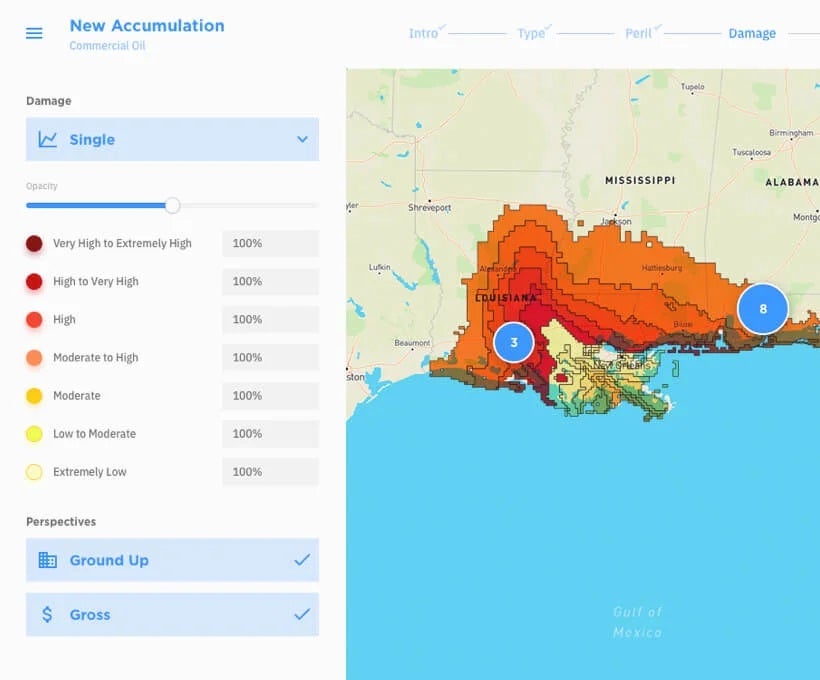

ExposureIQ

Manage your entire book of business more efficiently and accurately than ever before with this purpose-built solution for analyzing exposure concentrations.

Learn more

Risk Data Open Standard

Drive value and innovation from this new open standard, a modern data schema for risk analytics.

Learn more

TreatyIQ

Achieve your target portfolio by utilizing the advanced, customizable pricing and portfolio roll-up analytics direct to the property catastrophe underwriter.

Learn more

Learn more about unified modeling with Moody's