The Risk Data Open Standard is now available, and active industry collaboration is essential for achieving wide-scale interoperability objectives

On January 31, the first version of the Risk Data Open Standard™ (RDOS) was made available to the risk community and the public on the GitHub platform. The RDOS is an “open” standard because it is available with no fees or royalties and anyone can review, download, contribute to or leverage the RDOS for their own project.

With the potential to transform the way risk data is expressed and exchanged across the (re)insurance industry and beyond, the RDOS represents a new data model (i.e., a data specification or schema) specifically designed for holding all types of risk data, from exposure through model settings to results analyses.

The industry has longed recognized that a dramatic improvement in risk data container design is required to support current and future industry operations. The industry currently relies on data models for risk data exchange and storage that were originally designed to support property cat models over 20 years ago. These formats are incomplete. They do not capture critical information about contracts, business structures or model settings. This means that an analyst receiving data in these old formats has detective work to do – filling in the missing pieces of the risk puzzle. Because formats lack a complete picture linking exposures to results, highly skilled, well-paid people are wasting a huge amount of time, and efforts to automate are difficult, if not impossible, to achieve.

Existing formats are also very property-centric. As models for new insurance lines have emerged over the years, such as energy, agriculture and cyber, the risk data for these lines of business have either been forced suboptimally into the property cat data model, or entirely new formats have been created to support single lines of business. The industry is faced with two poor choices: accept substandard data or deal with many data formats – potentially one for each line of business – possibly multiplied by the number of companies who offer models for a particular line of business.

The industry is painfully aware of the problems we are trying to solve. The RDOS aims to provide a complete, flexible and interoperable data format ‘currency’ for exchange that will eliminate the time-consuming and costly data processes that are currently required

Paul Reed

RMS

“The industry is painfully aware of the problems we are trying to solve. The RDOS aims to provide a complete, flexible and interoperable data format ‘currency’ for exchange that will eliminate the time-consuming and costly data processes that are currently required,” explains Paul Reed, technical program manager for the RDOS at RMS. He adds, “Of course, adoption of a new standard can’t happen overnight, but because it is backward-compatible with the RMS EDM and RDM users have optionality through the transition period.”

Taking on the Challenge

The RDOS has great promise. An open standard specifically designed to represent and exchange risk data, it accommodates all categories of risk information across five critical information sets – exposure, contracts (coverage), business structures, model settings and results analyses. But can it really overcome the many intrinsic data hurdles currently constraining the industry?

According to Ryan Ogaard, senior vice president of model product management at RMS, its ability to do just that lies in the RDOS’s conceptual entity model. “The design is simple, yet complete, consisting of these five linked categories of information that provide an unambiguous, auditable view of risk analysis,” he explains. “Each data category is segregated – creating flexibility by isolating changes to any given part of the RDOS – but also linked in a single container to enable clear navigation through and understanding of any risk analysis, from the exposure and contracts through to the results.”

By adding critical information about the business structure and models used, the standard creates a complete data picture – a fully traceable description of any analysis. This unique capability is a result of the superior technical data model design that the RDOS brings to the data struggle, believes Reed.

“The RDOS delivers multiple technical advantages,” he says. “Firstly, it stores results data along with contracts, business structure and settings data, which combine to enable a clear and comprehensive understanding of analyses. Secondly, the contract definition language (CDL) and structure definition language (SDL) provide a powerful tool for unambiguously determining contract payouts from a set of claims. In addition, the data model design supports advanced database technology and can be implanted in several popular DB formats including object-relational and SQL. Flexibility has been designed into virtually every facet of the RDOS, with design for extensibility built into each of the five information entities.”

“New information sets can be introduced to the RDOS without impacting existing information,” Ogaard says. “This overcomes the challenges of model rigidity and provides the flexibility to capture multivendor modeling data, as well as the user’s own view of risk. This makes the standard future-proof and usable by a broad cross section of the (re)insurance industry and other industries.”

Opening Up the Standard

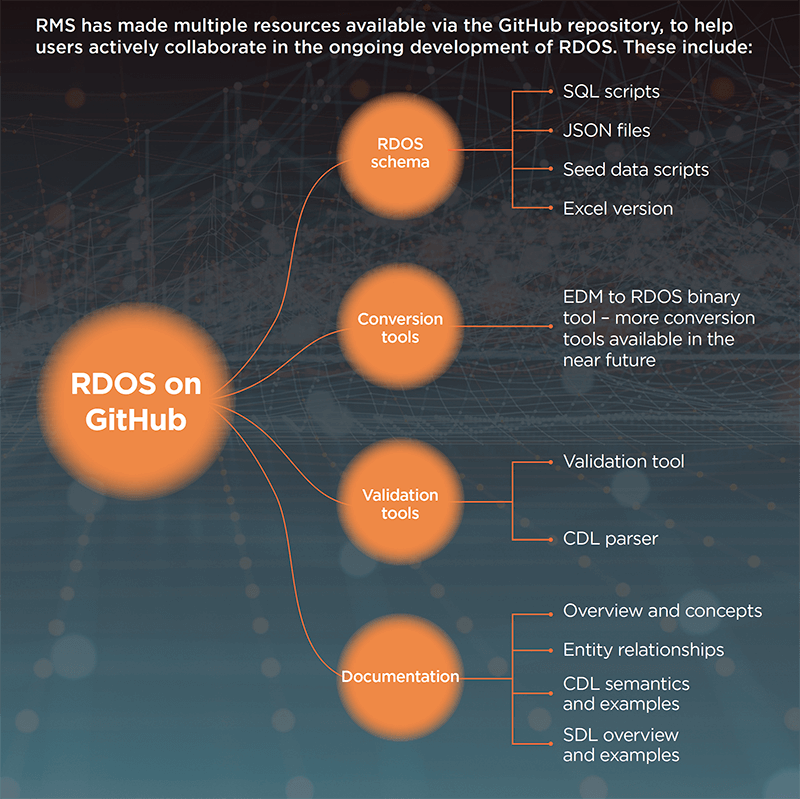

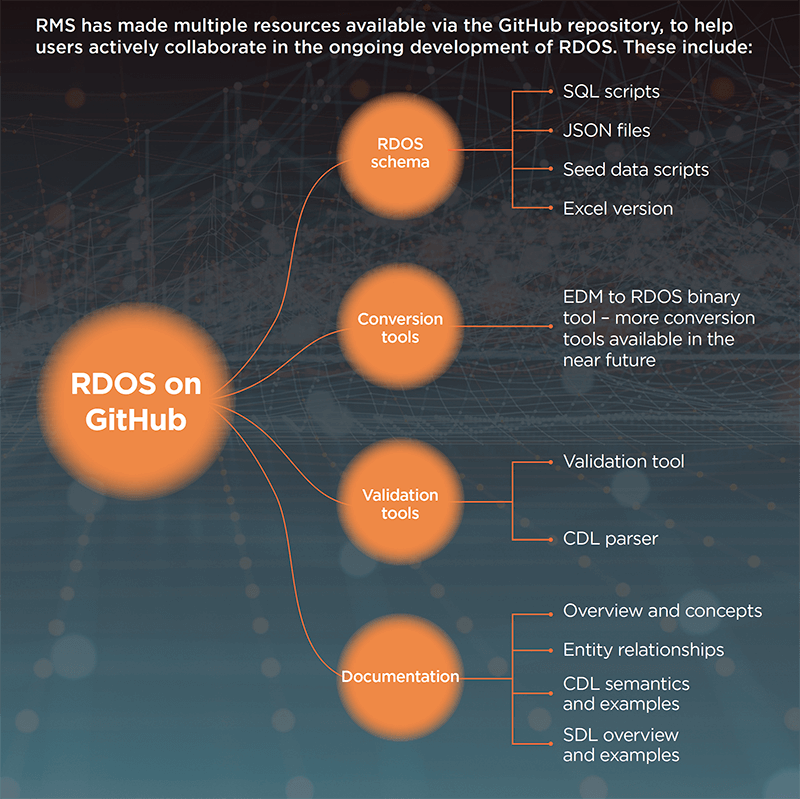

To achieve the ambitious objective of risk data interoperability, it was critical that the RDOS was founded on an open-source platform. Establishing the RDOS on the GitHub platform was a game-changing decision, according to Cihan Biyikoglu, executive vice president of product at RMS.

You have to recognize the immense scale of the data challenge that exists within the risk analysis field. To address it effectively will require a great deal of collaboration across a broad range of stakeholders. Having the RDOS as an open standard enables that scale of collaboration to occur.

“I’ve worked on a number of open-source projects,” he says, “and in my opinion an open-source standard is the most effective way of energizing an active community of contributors around a particular project.

“You have to recognize the immense scale of the data challenge that exists within the risk analysis field. To address it effectively will require a great deal of collaboration across a broad range of stakeholders. Having the RDOS as an open standard enables that scale of collaboration to occur.”

Concerns have been raised about whether, given its open-source status and the ambition to become a truly industrywide standard, RMS should continue to play a leading role in the ongoing development of the RDOS now that it is open to all.

Biyikoglu believes it should. “Many open-source projects start with a good initial offering but are not maintained over time and quickly become irrelevant. If you look at the successful projects, a common theme is that they emanate from an industry participant suffering greatly from the particular issue. In the early phase, they contribute the majority of the improvements, but as the project evolves and the active community expands, the responsibility for moving it forward is shared by all. And that is exactly what we expect to see with the RDOS.”

For Paul Reed, the open-source model provides a fair and open environment in which all parties can freely contribute. “By adopting proven open-source best practices and supported by the industry-driven RDOS Steering Committee, we are creating a level playing field in which all participants have an equal opportunity to contribute.”

Assessing The Potential

Following the initial release of the RDOS, much of the activity on the GitHub platform has involved downloading and reviewing the RDOS data model and tools, as users look to understand what it can offer and how it will function. However, as the open RDOS community builds and contributions are received, combined with guidance from industry experts on the steering committee, Ogaard is confident it will quickly start generating clear value on multiple fronts.

“The flexibility, adaptability and completeness of the RDOS structure create the potential to add tremendous industry value,” he believes, “by addressing the shortcomings of current data models in many areas. There is obvious value in standardized data for lines of business beyond property and in facilitating efficiency and automation. The RDOS could also help solve model interoperability problems. It’s really up to the industry to set the priorities for which problem to tackle first.

The flexibility, adaptability and completeness of the RDOS structure create the potential to add tremendous industry value

“Existing data formats were designed to handle property data,” Ogaard continues, “and do not accommodate new categories of exposure information. The RDOS Risk Item entity describes an exposure and enables new Risk Items to be created to represent any line of business or type of risk, without impacting any existing Risk Item. That means a user could add marine as a new type of Risk Item, with attributes specific to marine, and define contracts that cover marine exposure or its own loss type, without interfering with any existing Risk Item.”

The RDOS is only in its infancy, and how it evolves – and how quickly it evolves – lies firmly in the hands of the industry. RMS has laid out the new standard in the GitHub open-source environment and, while it remains committed to the open standard’s ongoing development, the direction that the RDOS takes is firmly in the hands of the (re)insurance community.

Access the Risk Data Open Standard here