The insurance industry is no stranger to the challenges of managing and sharing large data sets; the sheer size of insurance portfolios – which can run to millions of locations, places enormous strain on insurance workflows and supporting IT systems.

Firmly penciled into the industry calendar are the traditional reinsurance renewal deadlines, including 1/1, 4/1, and 7/1. Renewals represent particularly challenging periods for the industry, as primaries, reinsurers, and brokers distribute trillions of dollars of assets and millions of risks across the risk value chain.

During insurance renewals, the distribution of risk data comes into sharp focus for all stakeholders across the insurance value chain, as the requirement for exposure and modeled loss data to flow freely across primary insurers, reinsurance brokers, and reinsurers, becomes central to the renewal workflow.

However, the industry can struggle to attain the required level of data exchange between the various parties, primarily driven by challenges arising from incompatibility between data schemas and concerns around data governance.

Headwinds to Efficient Data Exchange: Data Schemas and Governance

Risk data for both exposures and losses is typically stored within multiple schemas and file versions, making data exchange between different firms difficult. To facilitate the exchange, each firm therefore needs to develop and maintain complex data mapping tools to map data between schemas and versions.

This use of multiple data schemas and versions also makes it difficult for firms to build a unified view of risk across their disciplines and for their stakeholders.

Recently, with Moody’s RMS Intelligent Risk Platform™ (IRP) we have taken steps to address this specific schema challenge by developing mappings for commonly utilized schemas such as Oasis Open Exposure Data (OED) and Verisk/AIR’s Catastrophe Exposure Database Exchange (CEDE).

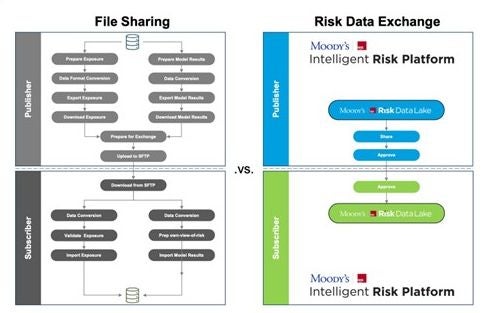

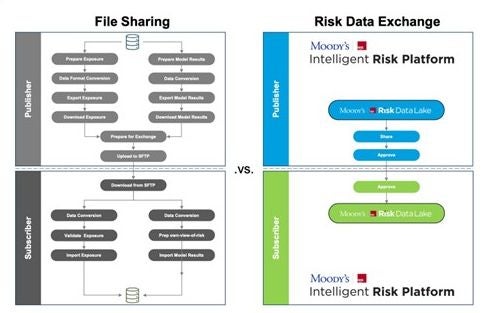

In addition, the data exchange workflow itself presents its own set of challenges. Data exchange processes are typically manual-based, time-consuming, and often involve multiple sequential steps.

To send or receive exposure or loss data, users spend a significant amount of time preparing, exporting, and downloading data, then uploading, and importing the data.

Users must navigate around multiple Secure File Transfer Protocol (SFTP) sites or similar techniques for exchanging the data, and as the security, version tracking, and size requirements for the exposures and losses grow, these traditional methods of exchanging the data start running into issues.

This forces users to implement more manual workarounds such as breaking up the portfolio data sets into smaller files or only exchanging the high-level data, etc. The technical limitations of these traditional methods could impact the quality of the risk data.

Lastly, due to the nature of these processes, there is very little governance – or oversight – on these data exchanges. Tracking multiple copies of the data, and understanding who sent what data to whom and when becomes very hard, presenting a nightmare from a data security perspective.

The diagram above depicts some of the complexity experienced by data publishers, such as preparing exposures and modeled loss results, data conversion, and data filtering requirements to prepare data for recipients.

In addition, publishers face complex tracking processes with received exposures and losses, versus a reinsurer's view of risk on those exposures, all received across data exchange systems such as FTP sites.

Risk Data Exchange is designed to simplify this complexity and help ensure data exchange can be effortlessly done more frequently.

Introducing Risk Data Exchange for Intelligent Risk Platform Clients

Moody’s RMS Risk Data Exchange is a new capability available at no additional cost for firms who license applications on the Intelligent Risk Platform such as Risk Modeler™, ExposureIQ™, UnderwriteIQ™, or TreatyIQ™, and is designed to make the exchange of data across the insurance value chain seamless and simple.

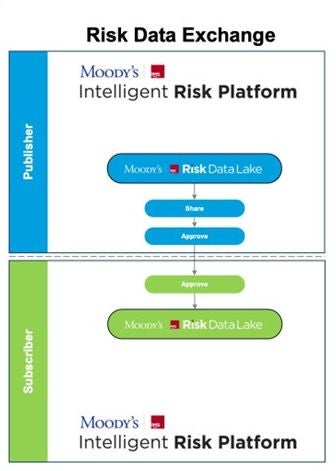

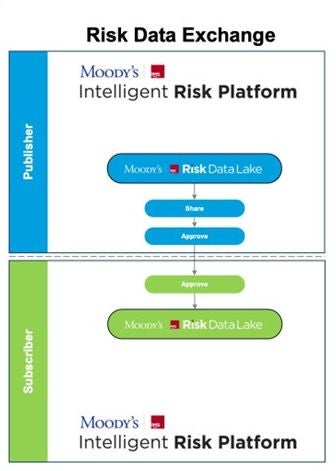

Utilizing the IRP’s cloud-native architecture, the Risk Data Exchange streamlines the sharing of exposure and results data from one to multiple tenants on the platform.

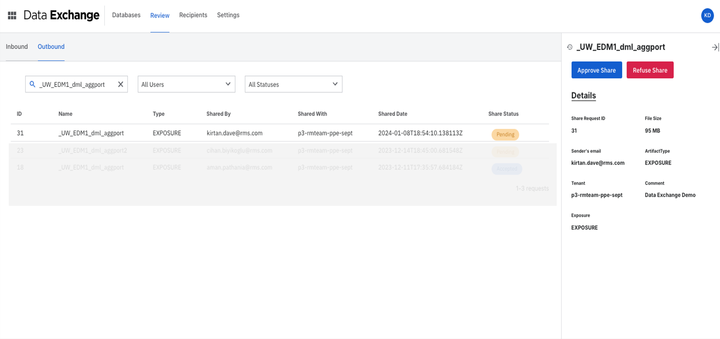

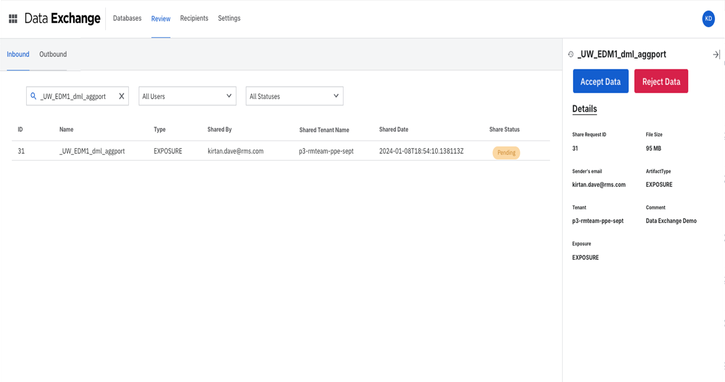

The capability also enables improved governance of the data exchange through audit and administrator approvals for both outbound and inbound exchanges.

With Risk Data Exchange firms can:

- Dedicate more time to analyzing risk by automating time-consuming manual processes in the risk transfer workflow.

- Maintain robust governance controls in the risk transfer workflow by securely sharing data with the right stakeholders on the platform.

- Minimize surprises during renewal periods by increasing the frequency of sharing governed datasets with risk partners.

Executing the New Data Sharing Workflow on the Intelligent Risk Platform

To facilitate the new data-sharing workflow, we are creating two new user roles for the Intelligent Risk Platform.

First, the tenant Data Exchange Administrator manages the governance for Risk Data Exchange and the Data Exchange User manages the execution of the workflow.

The table below shows the scope of each of the two user roles:

| Data Exchange Administrators |

Data Exchange Users |

|---|

| Generating a ‘Tenant Share ID’ which creates a unique ID for the tenant to share and receive exposure and results data. |

Initiating the data-sharing workflows once trusted partners have been established. |

| Defining the ‘Data Sharing Name.’ The corresponding public name of the Tenant ID of the tenant, which is displayed with trusted partners. |

Choosing the database and approved partners that the user wants to share data with. |

| Reviewing all the exchange activities between internal and internal partners, including partner approvals and receipt of exposure and results. |

Receiving notifications once administrators have approved/denied unique data share requests. After approval, partner data will be available for analysis. |

Once the Data Exchange Administrators approve the external tenant partners, the number of steps to share data is then reduced and streamlined:

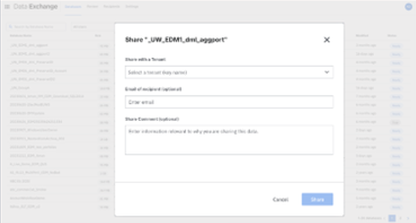

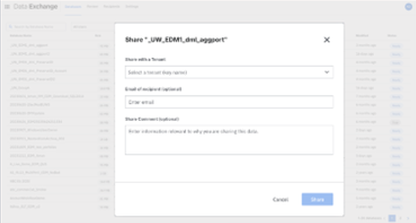

1) The Data Exchange User from the Publisher Tenant selects the database that they want to share. The user will select the subscribing partner from the approved list, provide the email address of the recipient (if known), and enter the comment to describe the share request.

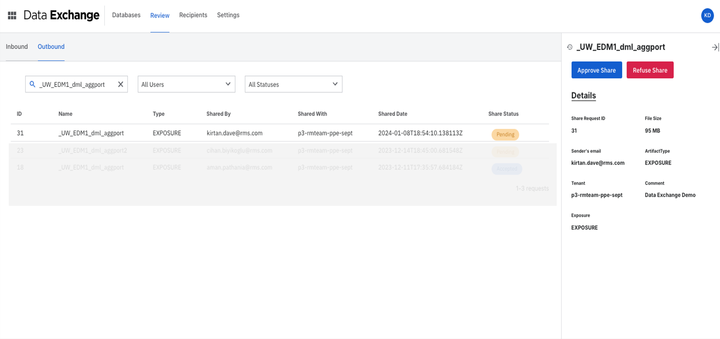

2) The Data Exchange Administrator of the Publisher Tenant receives a notification about the request to share. The administrator reviews the request and either approves or denies the share.

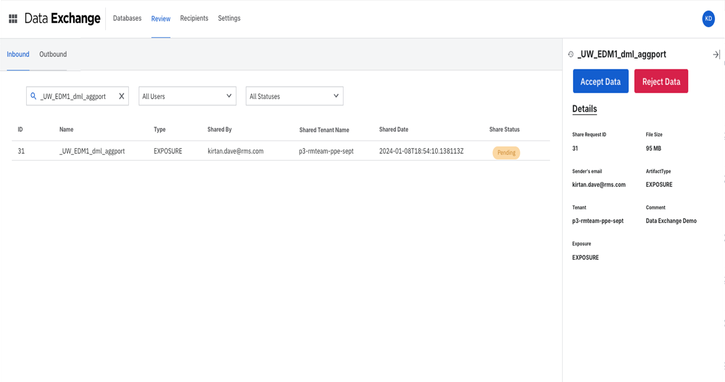

3) The Subscriber Data Exchange Administrator reviews the request, and approves the request, if appropriate.

4) The Subscriber Risk Data Exchange User is notified of the approval/denial. If approved, the data is made available in the platform for the user to start using in applications deployed in the platform.

The exchange of data between two tenants on the platform is that simple. Just select the data, initiate the share, get approval, and the data will be made available to the recipient tenant. There is no requirement to go through any data export, download, upload, or import steps.

As the data does not leave the Intelligent Risk Platform, the workflow is secure, enabling firms to maintain the highest security standards and follow industry best practices during the risk transfer workflow. Also, with all the data share activities logged, administrators can monitor and approve these data share activities.

Conclusion

Enabling a seamless exchange of risk data through Risk Data Exchange, the Intelligent Risk Platform continues to build on the vision of an open and collaborative set of applications for use across the insurance lifecycle.

This new capability providing seamless risk data exchange throughout the insurance value chain demonstrates the progress the platform is making in tackling the practical challenges of risk transfer and governance for the exchange of risk data.

To learn more about Risk Data Exchange, and how they support our customers to unify the risk lifecycle, please reach out to us to request a demo from one of our insurance specialists.