On behalf of all the team at RMS, I was delighted to accept the “Catastrophe Risk Modeler of the Year” award at the Insurance Asia News Awards for Excellence 2021. I would like to thank the organizers, the judges, and the Insurance Asia News team for another excellent awards ceremony. And, what is doubly exciting is the fact that this is the second time we have won this award in two years. It makes us feel as if we are doing something right for our customers in the region and the wider market.

Entering (and winning) awards makes you look back and reflect on your achievements as a business and examining the period covered by this award, it was still dominated by the global reaction to the COVID-19 pandemic. RMS like many other businesses has had to pivot to best serve customers, and we have worked very hard to help clients quickly get to and maintain “business as usual.” Our RMS Analytical Services team, with over 400 analysts, has done an amazing job helping clients by providing extra modeling resources.

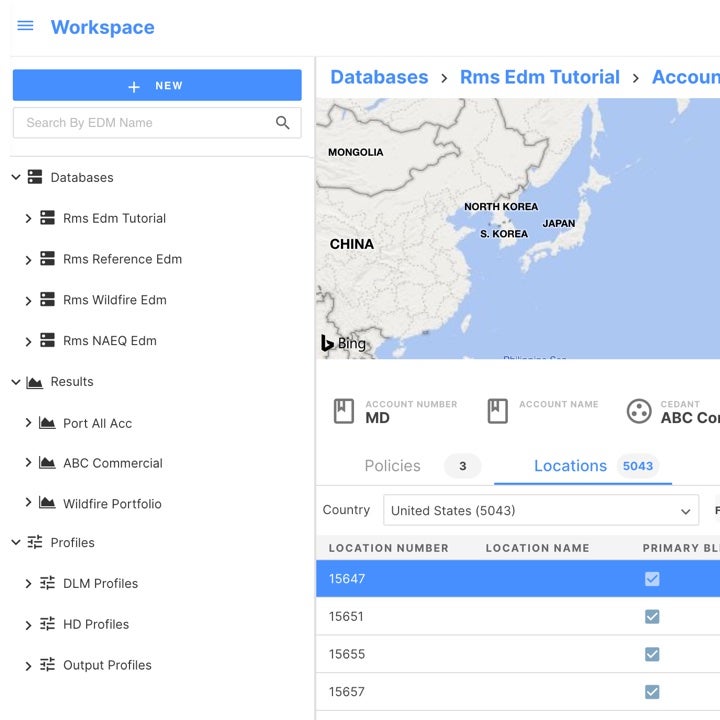

The pandemic has not slowed down the delivery of our product roadmap. RMS has continued to evolve our Risk Modeler™ application on the RMS Intelligent Risk platform™, a cloud-based risk analytics platform, to give a growing number of clients a unified modeling and analytics solution for their entire organization. With the ability to run portfolio and account modeling workflows, and promote real-time risk insights, clients can access existing (and new) aggregated loss models, detailed loss models, and a growing range of models using our high-definition risk modeling framework.

Our applications are also helping functions across an insurer’s business, and with ExposureIQ™ we see clients getting a more complete view of how losses flow through an entire organization – across both insurance and reinsurance, to access a true “net of reinsurance” metric. The application also integrates RMS Event Response and RMS HWind data to provide exposure managers with the latest potential impact from a catastrophic event.

Focus on Asia Flood Risk and Climate Change

RMS continued to build on our market-leading position and delivered a range of new flood models for markets across Asia Pacific, including China Inland Flood, Southeast Asia Inland Flood HD Model, and the New Zealand Inland Flood HD Model. Flood is the world’s most pervasive peril, and with the addition of these new models to our growing flood model suite, together with the launch of RMS Global Flood Maps, we now provide risk insight for 100% of gross written flood premium.

The recent COP26 climate change conference has also focused the world’s political and business leaders to redouble efforts to limit global warming to 1.5 degrees Celsius by 2050. With many insurers and financial institutions needing to provide disclosures on the future impact of climate change for both assets and liabilities, RMS is supporting clients with new climate change risk models and consulting support. This is helping address demands from regulators and stakeholders, and for clients to start building their climate change plans.

Our Event Response teams accelerated innovation during the pandemic, to deliver AI and Machine Learning techniques to analyze satellite imagery post-event, to deliver accurate insight within tighter timescales – especially where physical access has been limited.

Emerging Perils

Throughout the pandemic, RMS LifeRisks and the RMS Infectious Disease Model have kept clients up to date on the progress of COVID-19. RMS pioneered the probabilistic quantification of the impacts of infectious disease since 2006, and the model covers influenza and emerging infectious disease pandemics. As the pandemic has progressed, new data flowed into the model, from developments in vaccine production/manufacturing capacity, availability, and efficacy of pharmaceuticals, country-specific responses to the underlying health of insured portfolios. RMS produces regular projections on the number of cases, deaths, and hospitalizations regionally, to provide a better understanding of how different factors impact pandemic mortality.

Cyber is also a fast-growing peril for many insurers, and RMS Cyber Solutions Version 5.2 incorporates the latest risk landscape data into an integrated solution to help insurers safely and effectively manage and price cyber risk.

From our team in Asia Pacific, and across the globe, I’d like to again thank the judges for supporting us and naming RMS as “Catastrophe Risk Modeler of the Year”. We will work hard to see if we can make it three years in a row next year!