Detailed and Comprehensive Assessment of Earthquake Risk

The Canterbury Earthquake Sequence of 2010-2011 stands as the world’s second-largest insured loss from an earthquake, while the 2016 Kaikōura Earthquake ranks among the most complex seismic events ever recorded. The New Zealand Earthquake HD Model incorporates learnings and data from these significant events alongside the latest advancements in modeling methodologies to provide an unrivalled understanding of earthquake risk.

Navigate Tail Risk

Utilize the full spectrum of likely events that can affect exposures in New Zealand.

Shape Your Risk Perspective

Adjust model parameters to gain deeper insights into portfolio losses.

Enhance Risk-Based Pricing

Explicitly model the loss impact of all sub-perils including liquefaction and landslide.

The Unique Complexities of Managing New Zealand Earthquake Risk

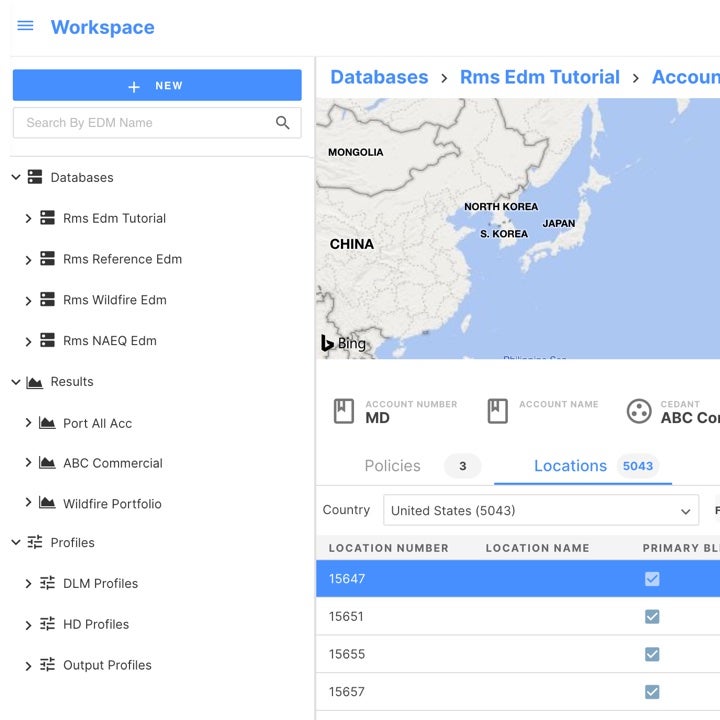

There are several factors that differentiate New Zealand Earthquake (re)insurance. Let’s look at how the Moody’s RMS New Zealand Earthquake HD Model helps you manage the risk with more confidence.

Related Products

Empower your expert team with the latest New Zealand Earthquake HD Model data and insights, including delivery of data directly to your underwriter's laptop or tablet device through an API to underwriting systems or access to the complete model.

Resources

Understanding the Aftershock Cloud: 10 Years on Since the ...

Since the year 2000, only one city located in an advanced market economy has been severely impacted by an earthquake. This was the Mw6.2 event that occurred on February 22, 2011, in Christchurch, the capital of South Island, New Zealand, with an epicenter at Port Hills on the southern edge of the city. This event was part of the 2010–11 Canterbury Earthquake Sequence, which started with the Mw7.1 Darfield Earthquake on September 4, 2010. The Christchurch event followed the Darfield quake some five-and-a-half...

Preparing for a 1-in-1,000 Year Loss: Insurance Resilience...

Not many countries have experienced a catastrophe that directly hit one of their largest cities, but for New Zealand, on February 22, 2011, an M6.2 earthquake struck less than 6 miles (10 kilometers) from the Christchurch central business district. The event generated significant ground motions and unprecedented and widespread liquefaction. Furthermore, it was the most destructive event of the Canterbury Earthquake Sequence (CES), a series of earthquakes across the region that started with the M7.1 Darfield Eart...

RMS Launches New Products and Models on RMS Risk Intellige...

NEWARK, CA – May 4, 2020 – As the world is changing in profound ways, so is risk. Climate change, pandemic events, and cyberattacks are threats we all now have to consider in new and innovative ways. With better understanding of risks, better decisions can be made, enabling better risk management end-to-end. Today, at the opening of its annual Exceedance conference, RMS®, the world’s leading catastrophe risk solutions company, announced significant new model and product releases and updates for RM...

New Zealand Earthquake: How the Last Decade Has Changed Ev...

Go back to this time 10 years ago and earthquake risk in New Zealand was a relatively low priority for the global (re)insurance industry; a decade later, and this perspective has certainly changed. Insured losses of around NZ$40 billion (US$24.1 billion) came from the 2010-2011 Canterbury Earthquake Sequence (CES) and the 2016 Kaikoura earthquake; the former is the world’s second largest earthquake insured loss. These events had a considerable impact across all aspects of society in New Zealand. They have als...

Insurance Australia Group (IAG) Selects RMS High Definitio...

Australia - October 15, 2018 RMS, the global risk modeling and analytics firm, today announces that Insurance Australia Group (IAG), a leading multinational insurer, has licensed the RMS High Definition New Zealand Earthquake Model. The RMS High Definition (HD) New Zealand Earthquake model is the world’s first earthquake model to benefit from the RMS HD model simulation-based framework which models tens of thousands of realizations of future earthquake scenario losses. This strengthens IAG’s abilit...

Should New Zealand Be Content with the New EQC Coverages a...

The revised earthquake coverages and caps proposed by the New Zealand Earthquake Commission (EQC) came into law as planned on July 1, 2019. As noted in an RMS blog back in February, these well signaled changes – to increase the building coverage from NZ$100,000 to NZ$150,000 and remove the NZ$20,000 contents cover, only had a small effect on the gross average annual loss for both EQC and the private market. Swapping the first layer of contents exposure for a larger, higher layer of building exposure pr...

De-risking the City

I am in Wellington, New Zealand, looking out from a rainy hotel window high over the city, admiring the older wooden houses on the forested slopes. Below there are four to eight story office and retail buildings, a number of which are shrouded in scaffolding, still repairing damage from the 2016 Kaikoura earthquake. The earthquake epicenter was some distance from the city, but the pattern of fault ruptures propelled long period ground shaking into the heart of Wellington. In 1848, only eight years after the c...

How Will Insurers Be Affected by Changes in New Zealand EQ...

Around 98 percent of residential homes in New Zealand have earthquake insurance. This remarkable achievement is due to a unique partnership between the New Zealand government Earthquake Commission (EQC) working together with the insurance industry. From its origins in 1945 as the Earthquake and War Damage Commission – renamed as the EQC in 1993, the Commission is supported by an Act of Parliament which sees the Crown as the insurer of first resort for earthquakes in New Zealand. The EQC provides the first layer ...

Find the Model to Fit Your Needs