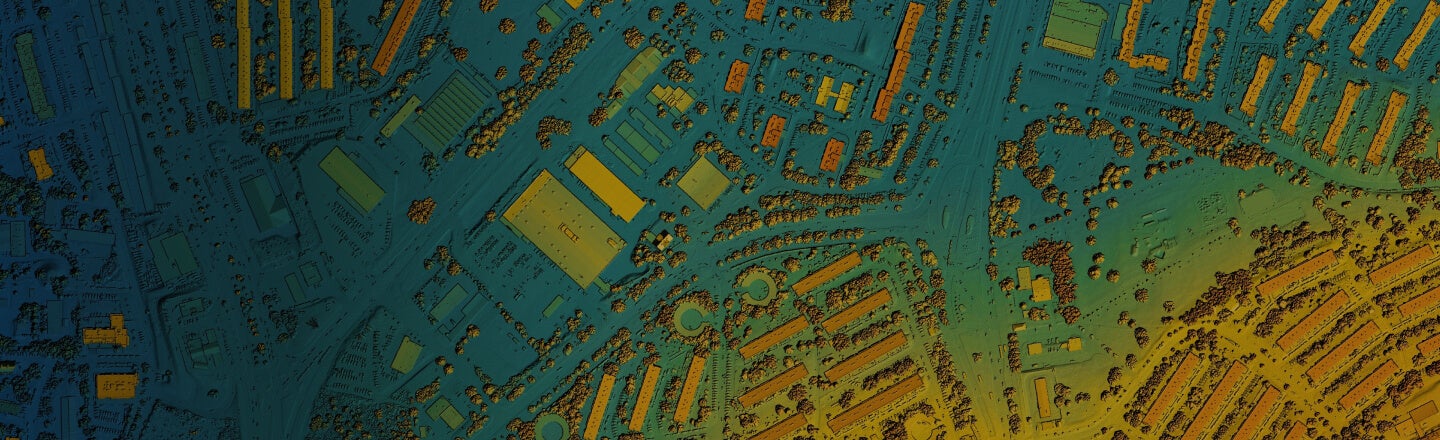

Risks Aren’t Always Risks, Sometimes They’re Opportunities

Every (re)insurance company has a mandate to generate business value. Each value area can help uncover improvements in financial metrics.

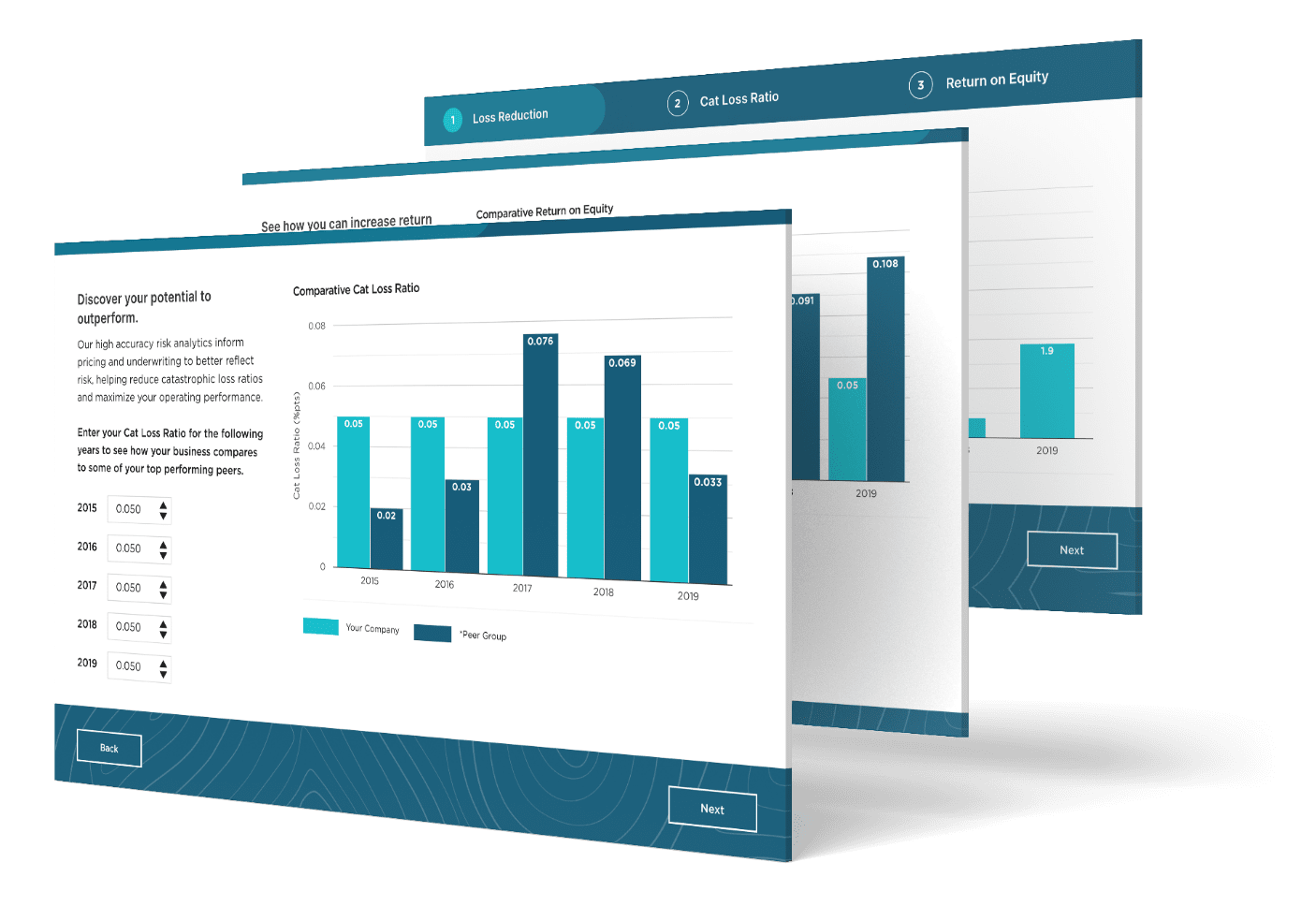

Assess Your Risk Management Performance

Use our Comparative Performance Calculator to understand the impact of enterprise risk management investments on your business metrics. See its impact on catastrophe losses, return on equity, and the ability to outperform your peers.

See How Others Transform Risk into Value

Whether you want to provide more accurate loss estimates, improve underwriting profitability, or create a portfolio of risk exposures optimized for your business, find out how Moody's RMS helps companies lead and achieve.

News and Insights

Climate Change and Insurance: Time to Face the Risks

Understand the underlying risks of climate change

U.S. Wildfire: Calculating the Value of Mitigation Benefits From Forest Treatment Strategies

Exposure Management: Managing the Complexity of Estimating Net Losses Across Property Treaty Business

Industry Insights, Risk Perspective, Trending Now.

Fast Access To Curated Content By Topics

Find Your Channel

Learn How Moody’s RMS Can Help Your Business Outperform