Key Takeaways

- Higher levels of customer satisfaction and retention.

- More targeted when identifying prospects and cross-selling opportunities.

- Ability to scale up rapidly when needed.

- Onboarding of new analytics providers in days, not weeks

- Reduced processing times from hours to minutes

- Heightened data accuracy at all stages

- Integrated 95 percent of workflows into the platform in the first quarter of use

The Challenge – Get More Value From Data and Analytics

A leading property and casualty insurance broker was looking to differentiate itself from the competition by better leveraging data and analytics. It wanted a solution to provide actionable insights that could integrate quickly and seamlessly into business workflows. The goal was to grow the business by deepening customer relationships and better identifying opportunities.

From a workflow perspective, the company needed the new capabilities to integrate seamlessly and efficiently into current risk management tools. In addition, the solution had to be easy to access, with no additional support requirements or infrastructure costs.

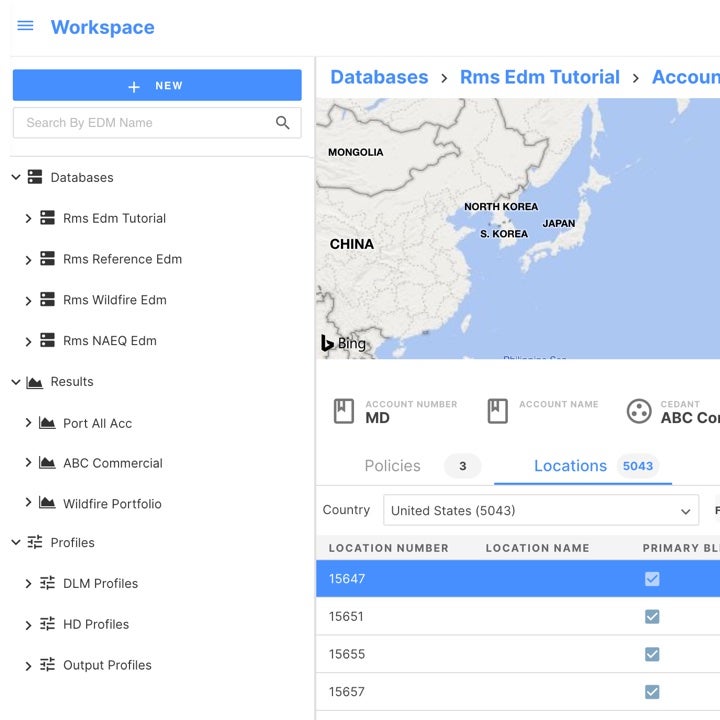

The Solution – Moodys RMS Risk Modeler to Gain Real-Time Insights

The intermediary chose Moody’s RMS Risk Modeler™ to provide near real-time insights into day-to-day business decision-making across the organization. As a SaaS product, Risk Modeler provided improved workflows, better features, and core functions, such as public APIs, which allowed seamless integration into existing systems.

The Outcome – Higher Levels of Customer Retention and Competitiveness

The company has taken a significant leap in its digital journey and is more competitive among its broker peers as a result.

By capitalizing on Risk Modeler’s centralized, enhanced, and intuitive analytical functionality and reporting capabilities, the broker heightened data accuracy at all stages and enabled the company to gain a deeper understanding of client portfolios.

Risk Modeler’s intelligent workflows have also helped minimize operational burdens – with over 95 percent of workflows integrated into the platform in the first quarter of use – reducing processing times from hours to minutes for numerous functions. Further, the platform’s flexibility enabled the rapid onboarding of new risk analysts and cat modelers, and during busy periods the company can scale up easily and efficiently.