Key Takeaways

- Single, on-demand view of risk.

- Future-proofed architecture for cat modeling.

- Ability to scale up during peak renewal times.

- Rapid onboarding of risk analysts and cat modelers.

- Future Proofed Architecture

- Integrated 95 percent of workflows into the platform in the first quarter of use

- Better-informed decisions and more balanced books of business.

The Challenge – Improve Risk Selection and Reduce Catastrophe Claims

To stay competitive in an industry that is being disrupted, one of North America’s largest property and casualty insurers needed an innovative risk modeling solution to improve its underwriting process. The goal was to select better risks and reduce losses for flood, windstorm, and earthquake. It was essential to ensure minimal disruption and simply enhance risk insights at the point of underwriting decision-making.

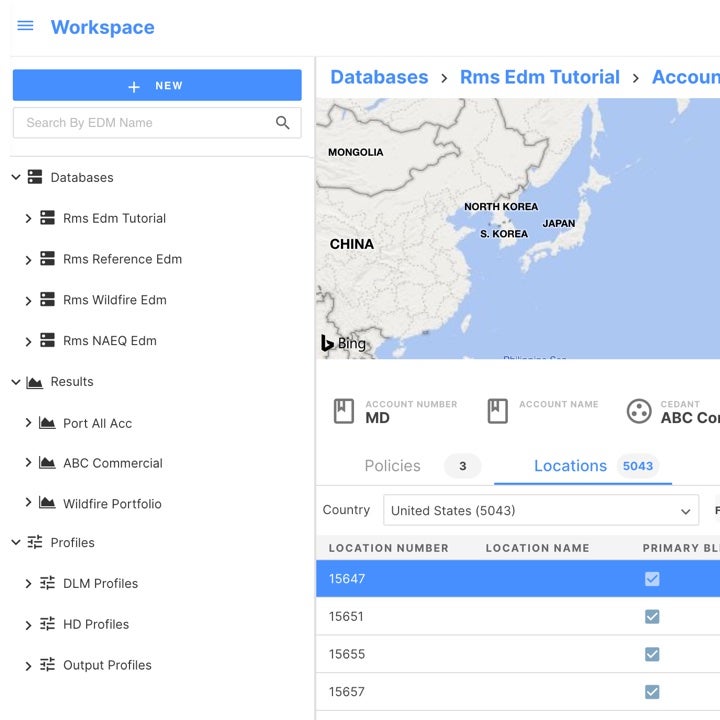

The Solution – Moody's RMS Risk Modeler for Cloud, Models, and Services

After carefully considering solutions from various catastrophe risk analytics providers, the company felt confident Moody's RMS was the right choice for cloud, models, and services. It selected Risk Modeler™ to access, evaluate, compare, and deploy all RMS catastrophe models – including RiskLink® and Moody's RMS High Definition Models™ – using a single modeling application.

The Outcome – Complete On-Demand View of Risk at the Point of Underwriting, Facilitating Better-Informed Decisions, and More Balanced Books of Business

The carrier now has a complete view of risk across natural catastrophes with side-by-side model versions in one application. This created a complete on-demand view of risk at the point of underwriting, facilitating better-informed decisions and more balanced books of business.