On May 22, 1960 the most powerful earthquake ever recorded struck approximately 100 miles off the coast of southern Chile. The 9.5 Mw event released the energy equivalent to 2.67 gigatones of TNT (178,000 times the energy yielded from the atomic bomb dropped on Hiroshima) leading to extreme ground shaking in cities such as Valdivia and Puerto Montt, triggering landslides and rockfalls in the Andes as well as resulting in a Pacific basin wide tsunami. In Chile, 58,622 houses were completely destroyed with damages totalling $550 million (~$4 billion today adjusted for inflation).

However, the effects in the far field were also significant. While the majority of the damage and approximately 1,380 fatalities occurred in close proximity to the earthquake, a proportion of the tsunami death toll and damage occurred over 5,000 miles away from the epicentre and reached as far away as Japan and the Philippines.

Such tsunamis with the potential to cause damage and fatalities at locations distant from their source are known as tele-tsunamis or far-field tsunamis and require a large magnitude earthquake (>7.5) on a subduction zone to be triggered. Recent events, such as the 2011 Tohoku and 2010 Maule earthquakes, demonstrated that even if these criteria are met, the effects of any resulting tsunami may not be felt significantly beyond the immediate coastline. As such, it can be easy to forget the risks at potential far field sites. However, the 55th anniversary of the 1960 Chilean earthquake and tsunami provides a useful reminder that megathrust earthquakes can have far reaching consequences.

Across the Pacific, the 1960 tsunami caused 61 deaths and $75 million damage (~$600 million today) in Hawaii, 138 deaths and $50 million damage (~$400 million today) in Japan, and left 32 dead or missing in the Philippines.

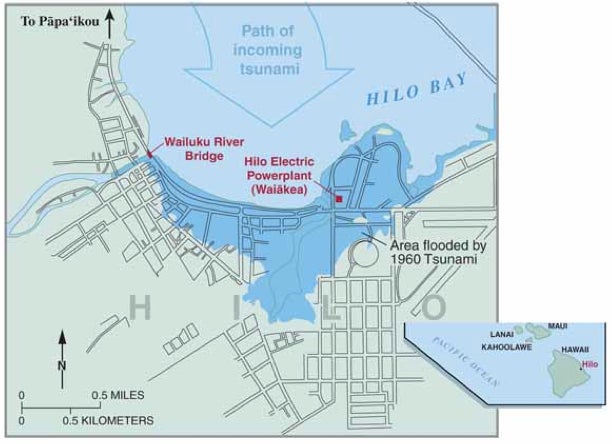

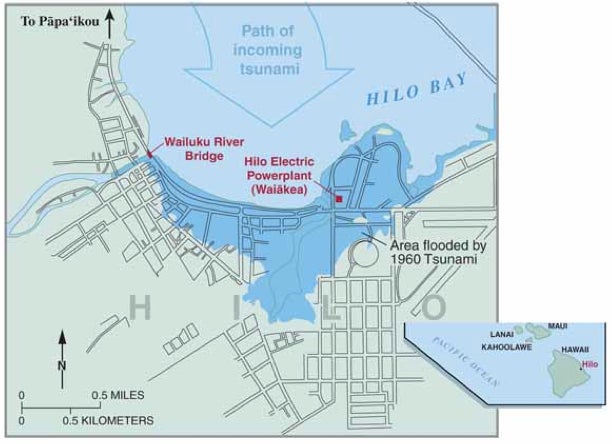

Hilo Bay, on the big island of Hawaii, was particularly hard hit with wave heights reaching 35 feet (~11 meters), compared to only 3-17 feet or 1-5 meters elsewhere in Hawaii. Approximately 540 homes and businesses were destroyed or severely damaged, wiping out much of downtown Hilo.

Aftermath of the event in Hilo (USGS) Inundation extent of the 1960 tsunami in Hilo (USGS)

Despite an official warning from the U.S. Coast and Geodetic Survey and the sounding of coastal sirens, 61 people in Hilo died as a result of the tsunami and an additional 282 were badly injured. The majority of these casualties occurred because people did not evacuate, either due to misunderstanding or not taking the warnings seriously. Many remained in the Waiakea peninsula area, which was perceived to be safe due to the minimal damage experienced there during the event triggered by the 1946 Aleutian Islands earthquake.

Others initially evacuated to higher ground but returned before the event had finished. A series of waves is a common feature of far field tsunamis, with the first wave typically not being the largest. This was the case with the 1960 event with a series of 8 waves striking Hawaii. Thethird of these was most damaging, killing many of those who returned prematurely.

These avoidable casualties highlight the need for adequate tsunami mitigation measures, including education to ensure that people understand the warnings and the correct actions to take in the event of a tsunami. This is particularly important in areas exposed to far field tsunami hazard, where people may be less aware of the risk and there is enough time to evacuate. The introduction of a Pacific Tsunami Warning System in 1968 as a consequence of the event was a big step forward in improving such measures, the presence of which would no doubt substantially reduce the death toll were the event to reoccur today.

Mitigation efforts can also be supported by tools like the RMS Global Tsunami Scenario Catalog, which provides information on the inundation extent and maximum inundation depth for numerous potential tsunami scenarios around the globe. This can be used to identify areas at risk to far-field tsunami events, including those with no historical precedent, enabling the quantification of exposures likely to be worst impacted by such events.