At a time when the U.S. property catastrophe sector is experiencing heightened competition, flood insurance offers untapped potential that can benefit (re)insurers, the government and emergency management organizations, explains RMS flood risk expert Jeff Waters.

Opportunities begin at the coast, where storm surge-driven coastal flooding stimulates the majority of the flood risk profile. Using a variety of newly available flood tools, probabilistic models and location-level analytics, private carriers can quantify coastal flood risk accurately, allowing them to determine the size and extent of opportunities and where to capitalize on them.

Coastal flood is a unique peril due to its complex hydrodynamic characteristics and highly granular gradients. The magnitude and severity of U.S. coastal flood risk is dependent on a number of factors, including the shape of the coastline, local bathymetric and topographic profiles, slope and elevation. From a (re)insurer’s perspective, it’s also highly dependent on building characteristics, such as first-floor elevation or presence of flood defenses, as well as flood coverage conditions and exclusions.

In the U.S., the majority of the coastal flood risk profile is driven by storm surge from tropical cyclone events. Consequently, the most susceptible areas are located along the Gulf Coast and Eastern Seaboard, where exposures are high and distance to the coast is low. According to RMS research, there is more than $11 trillion in exposure in coastal ZIP codes from Texas to Maine, especially in the last 10-15 years.

In 2005, Hurricane Katrina caused $15 billion in economic storm surge losses in Orleans Parish alone, which includes the city of New Orleans. It was the first time in decades that over 50 percent of losses from a hurricane were driven by storm surge. Levee and flood wall failures caused flooding across 80 percent of New Orleans, devastating much of the city and costing the insurance industry $41 billion (at 2005 prices) in catastrophe claims.

“ACCORDING TO RMS RESEARCH THERE IS MORE THAN $11 TRILLION IN EXPOSURE IN COASTAL ZIP CODES FROM TEXAS TO MAINE.”

Storm surge was once again a major driver of loss during Superstorm Sandy in 2012. The pulse of seawater pushed ashore by the storm’s hurricane-force winds flooded streets, tunnels and subway lines in New York City and surrounding areas, causing insured losses of nearly $19 billion, 60 percent of which was attributed to coastal flooding.

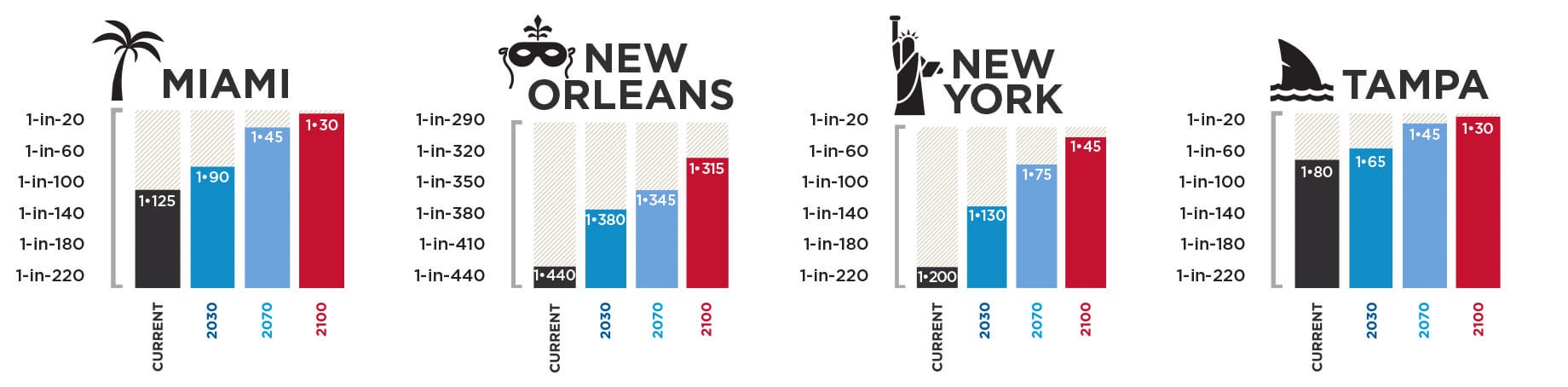

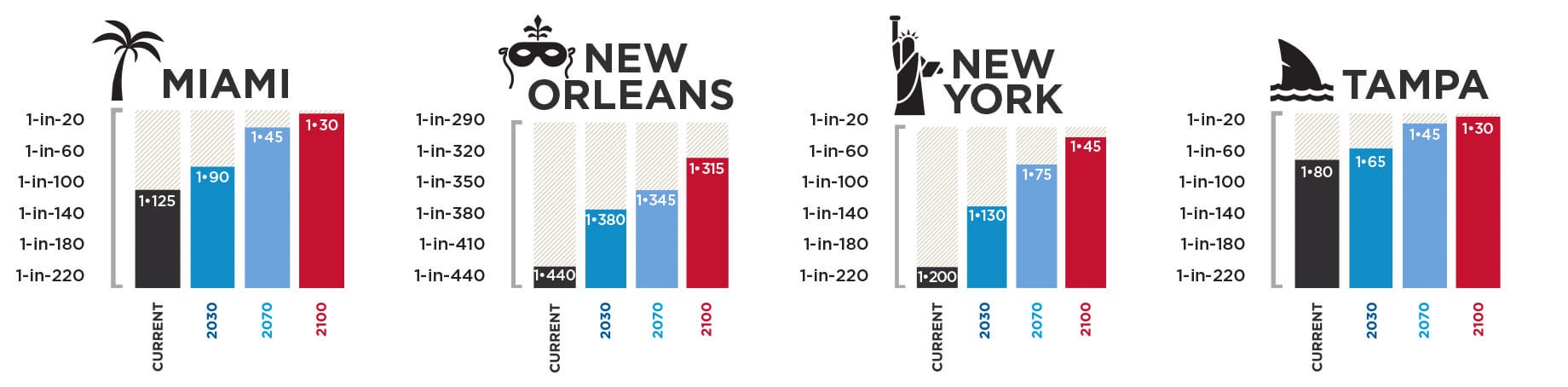

Surge risk is only going to increase in the future. Risk and corresponding losses from hurricane-induced storm surge are expected to grow as a result of sea-level rise and increasing coastal exposures. In 2014, RMS partnered with the Risky Business Initiative to quantify and publicize the economic risks of climate change in the U.S. Among other findings, the study determined that by mid-century, storm surge has the potential to generate more than half of economic losses from landfalling hurricanes in the U.S.

The U.S. Flood Opportunity – It Starts on the Coast

The movement towards privatizing the U.S. flood insurance market reflects concern surrounding the flood “protection gap” and the unsustainability of the National Flood Insurance Program (NFIP), which has amassed more than $23 billion in debt by offering coverage at rates that do not reflect the true underlying risk. This is especially true in highly exposed coastal zones, where it is estimated that as much as 20 percent of NFIP flood insurance rates are subsidized.

Unlocking the potential for flood privatization nationwide will depend on a number of factors, from federal and state-level legislative reform to the implementation of more actuarially sound rates. It may take years before the private flood market is mature, but the foundation is taking shape and opportunities are materializing.

Figure 1. Current and projected 100-year return period economic storm surge losses. (Source: RMS)

In the meantime, it is important to recognize where private carriers can begin to assess and capitalize on these opportunities today – the hurricane coast. Here, where many FEMA high-risk flood zones (A and V) are located, NFIP participation ranges from 10 percent to 70 percent, according to RMS. It is also an area for which model vendors have developed a number of advanced flood analytics, from probabilistic models to hazard data, both of which provide a more comprehensive view of the coastal flood risk landscape and enable private carriers to quantify coastal flood risk more accurately.

Probabilistic storm surge models are widely available in the market today. Often integrated with a broader hurricane or wind model solution, they provide frequency, severity and uncertainty metrics for a spectrum of potential coastal flood events, helping to inform more accurate portfolio management, reinsurance pricing and risk transfer decisions.

Flood hazard metrics, on the other hand, are newer to the market. They provide varying views of flood extent and severity throughout the U.S., depending on the provider. In many cases they represent hazard on a more granular basis than is currently possible using FEMA maps, enabling carriers to differentiate risks within flood zones with more precision and accuracy, and determine where FEMA may be over- or underestimating flood hazard in a given location to, ultimately, select (or avoid) the risk vis-à-vis the NFIP. For example, the recently released RMS U.S. Flood Hazard Data provides defended and undefended views of flood hazard extent and severity for multiple return periods, reflecting all sources of both coastal and inland flooding.

As the private flood insurance market continues to take shape, enhanced flood analytics can be used to gain important insights into potential flood events before they occur, particularly along the coast, allowing (re)insurers to be more proactive than reactive when developing, managing and growing a profitable flood portfolio. Success will, however, depend largely on the ability of the market to quantify flood risk with sufficient granularity and to offer actuarially sound rates that allow (re)insurers to obtain a profitable return.

Advice to (Re)insurers Looking to Grow a Coastal Flood Portfolio

Collect high-quality, flood-relevant exposure data.

- Knowing precise location and elevation information, such as distance to coast and the presence of local flood defenses, is just as important as knowing the structural profile.

- Having important elevation information, such as the height of the lowest occupied floor or the threshold flood height, helps determine the approximate water level needed to cause damage to the property.

Understand the correlation between surge and other types of coastal hazards, and how it translates to policy terms and conditions.

- Hurricane wind and surge impacts are often correlated; knowing where and to what extent can help you avoid overconcentration of risk.

- Tropical cyclone-induced precipitation can also drive a significant amount of damages along the coast.

Know the potential future impacts of large-scale climate and exposure patterns.

- By mid-century, storm surge is expected to generate more than half of the economic losses coming from landfalling U.S. hurricanes.

- With sea-level rise comes an increased likelihood for catastrophic surge events, especially in coastal cities with shallow sloping coastal profiles (Tampa, FL).

Jeff Waters is responsible for guiding the insurance market’s understanding and usage of RMS North America climate models, including the hurricane, severe convective storm and winter storm models.