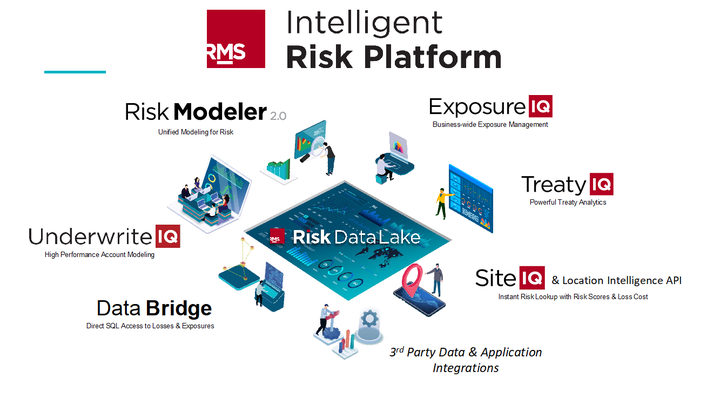

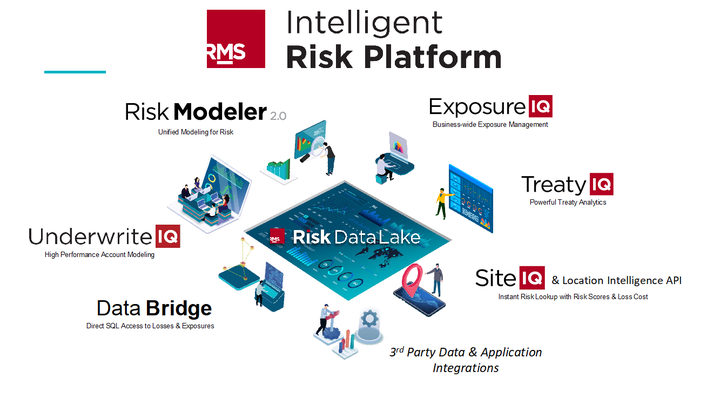

The Moody’s RMS Intelligent Risk Platform™ is designed as a collaborative environment that can facilitate multiple applications, with Risk Modeler™, ExposureIQ™, UnderwriteIQ™, TreatyIQ™, and SiteIQ™ all representing examples of applications that are built on the platform.

Being built on a unified risk framework, these applications all share numerous services and speak the same ‘data language.’ It’s not an easy endeavor but this unified risk framework ensures multiple teams, using different applications, all benefit from analytic results from a ‘single version of truth.’

In this blog post, we will explore various examples that help illustrate why a single version of truth matters, and how teams that use multiple applications on the Intelligent Risk Platform can unlock new benefits through the collaborative power of these applications.

It is important to note this is still the early days for the Intelligent Risk Platform, even though already over 100 clients have adopted the platform as of December 2022.

As a result, this post can’t be an exhaustive list of all use cases and workflows, because as new partners integrate their models, data, and apps, and as new applications launch on the platform, new clients will then onboard and customize the platform to their needs, and new use cases will emerge.

But let’s unpack some of the most common examples from our insurer clients who are using applications on the platform. First, we start with introducing the applications running on the platform today, which are all designed for key decision-making disciplines and teams.

- Risk Modeler™: An application designed for cat modelers to help set a company’s risk strategy using risk models. Cat modelers who have used Moody’s RMS RiskLink® will find Risk Modeler offers a familiar user environment, and also includes plenty of enhancements, bringing additional flexibility to model validation and portfolio modeling workflows.

- ExposureIQ™: Designed for exposure managers, ExposureIQ is an application that helps better understand risk concentrations, hot and cold spots within a portfolio, build ‘what-if‘ analyses, and deliver a detailed understanding of cat events with support for accumulation management pre, during, and post-event.

- UnderwriteIQ™: Underwriters can access analytics at the point of underwriting, and use this application to efficiently price risk using risk models and data. (Please note: UnderwriteIQ is currently only available as a preview for early adopter customers, with general availability in the first half of 2023.)

- Data Bridge: A programmable access endpoint that allows sophisticated users to utilize SQL to access live risk data across multiple applications.

- SiteIQ™: Managing General Agents (MGAs) and cover holders can establish a ‘digital thread’ with their underwriters using this application, to set and align underwriting strategy based on instant risk scores.

- TreatyIQ™: Designed to equip treaty underwriters, TreatyIQ is an application offering flexible program structuring and analytics, along with portfolio monitoring, for better reinsurance pricing and risk selection.

Developing a Consistent Risk Strategy for Underwriting

For our first use case, we’ll look at how Risk Modeler, UnderwriteIQ, and SiteIQ all work together to create a consistent risk strategy that multiple teams can agree on and apply to their operations.

As cat modeling teams set and evolve a company’s risk strategy, one of the hardest things to achieve is communicating a risk strategy to underwriters – and consistently applying the strategy to the underwriting process.

To achieve this using the applications on the platform, the workflow starts with risk analysts using Risk Modeler, accessing risk models within the model validation process, to validate against their company’s own loss experience.

The risk analyst team then uses Risk Modeler to establish risk profiles for each peril and region to represent the risk tolerance of the insurer, which helps guide the team to more profitable risks.

With the shared data and metadata design within the Intelligent Risk Platform, underwriting teams can simply utilize these preset risk profiles from Risk Modeler without having to ask modeling teams for detailed account modeling data runs.

All shared risk profiles from Risk Modeler are then automatically available and set up for each peril and region for underwriters to use in UnderwriteIQ. As the cat modelers evolve the risk strategy, it is simple to apply these new risk profiles to support the strategy in UnderwriteIQ.

These shared risk profiles ensure a consistent understanding of the risk and enable touchless and well-informed pricing at the point of underwriting. For the supervised underwriting process, UnderwriteIQ also simplifies and crafts model output for underwriters with easy-to-consume loss analytics.

Built into SiteIQ is another workflow that helps underwriters maintain a consistent digital thread with their partnering cover holders and MGAs. As underwriters delegate authority to their partnering MGAs and cover holders, they can use SiteIQ to set limits and express whether a risk is acceptable or not, where to continue to underwrite, and where to stop underwriting more risk.

‘Gold Copies’ of Risk Portfolios

In this workflow, we’ll look at Risk Modeler, ExposureIQ, and UnderwriteIQ working together on a single, consistent portfolio. Taking decisions based on an inconsistent view of risk within a company’s portfolio may lead to costly mistakes, whether as a result of breaching underwriting limits or where high concentrations of risk may cause unexpected losses.

As a company’s portfolio evolves, having a shared understanding of a portfolio’s current position – a gold copy of a risk portfolio – helps to establish the marginal impact of new risks, as accounts and portfolios are then considered across the company’s insurance or reinsurance practices.

For instance, golden copies of a company’s U.S. portfolio are first modeled through Risk Modeler to ensure a company’s own view of risk is well captured across multiple perils.

Both the exposures and modeled losses are available through Data Bridge where top risk analysts can use SQL to dig deep into the details of the portfolio and edit various aspects of exposures and losses that can help enhance modeled output or create custom reporting over the existing portfolio.

And with the architecture built into the Intelligent Risk Platform, the same portfolios, accounts, policies, and treaties are all available to exposure management teams using ExposureIQ.

ExposureIQ users can test the accumulation of risk and compare accumulations over time as the golden copy of the portfolio evolves, watching for risk concentrations in the portfolio and identifying opportunities.

With UnderwriteIQ, as the underwriting teams consider new commercial accounts to add to the portfolio, they can pressure test the existing portfolio with ‘what-if’ analyses to understand the impact of a new account on the overall total portfolio risk.

As new accounts are added to the portfolio, updated snapshots can be shared to help with the accurate calculation of marginal impact.

At the same time, reinsurance teams can use the shared portfolios to consider their reinsurance purchases and test new limits and terms. As reinsurance purchases are committed to, they can then be added to the portfolio’s details to ensure new risks are being tested, and the marginal impact can be considered in all of its aspects, including the net of reinsurance financial perspectives.

Unified Event Response

In this final workflow, we’ll look at how multiple teams responding to a cat event can use ExposureIQ, Risk Modeler, and UnderwriteIQ to deliver consistent and real-time analytics to assess losses and reassess their risk appetite.

Clients are already benefiting from a unified event response process, for instance, as a hurricane event approaches the coast, exposure management teams can use event forecast footprints from Moody’s RMS HWind in ExposureIQ.

The refreshed footprints represent the most up-to-date probabilities of where an event may hit, giving insurers the chance to warn customers to minimize damage and invoke claim procedures for more effective customer service.

As an event unfolds, cat modeling teams can also run the identified event footprint through Risk Modeler to understand damage estimates with the ability to explore uncertainties around the event using the risk models.

The same event footprints in ExposureIQ combined with the gold copy of the portfolio impacted by the event, allow exposure teams to build a range of damage estimates using factors based on Moody’s RMS data or other sources of event information.

Accumulation reports can be prepared using ExposureIQ and then sent to senior executives. As an event unfolds further, any additional feedback enhancing the understanding of the event can be refreshed in ExposureIQ and analyses can be easily regenerated.

Using the details of the event, risk analysts can guide underwriting teams with UnderwriteIQ, which can be used to set moratoriums and make sure underwriting teams do not further exacerbate the risk from the event.

These three use cases that we have illustrated represent just a few ways we see customers benefiting from the Intelligent Risk Platform’s connected applications.

There are many more that simply comes from the ability to share settings, profiles, geocoding engines, and currency tables for converting a multitude of currencies across portfolios, all of which create natural consistencies among teams using the platform applications.

As a part of the Moody’s RMS team, we are super excited to watch clients discover even more ways to utilize these collaborative powers. We are also opening new doors every day for more opportunities, as new applications are delivered from Moody’s RMS, new partners bring their models, data, and applications, and new clients onboard onto the platform.

If you’d like to learn more about Intelligent Risk Platform and its applications, please click here.