Build underwriting workflows in the new world of risk

Drawing on our more than 30 years of risk analytics leadership, UnderwriteIQ™ takes advantage of industry-leading models, data products, and technology to deliver trusted, agile analytics that seamlessly plug into your underwriting workbench. Our industry-standard REST APIs facilitate greater automation to increase underwriting throughput, so you can easily embed impactful insights into existing underwriting systems, new digital workflows, or even partner systems that utilize advanced analytics.

Price risks with confidence

Select and screen high-value risks, with superior exposure data, global hazard layers, and science.

Increase underwriting throughput

Automate underwriting workflows leveraging high performance & scalable cloud-native architecture.

Enhance decision-making

Deliver a common set of analytics across your organization and the risk transfer lifecycle.

Why UnderwriteIQ for property and casualty underwriting

Property and casualty underwriting is becoming an increasingly challenging line of business for insurers. In a market experiencing digital disruption, underwriting speed, data quality and analytics, and automation are more important than ever before. UnderwriteIQ is tailored to the unique needs of underwriters and is designed to drive more consistent risk analytics across your organization.

Innovative solutions for your biggest challenges

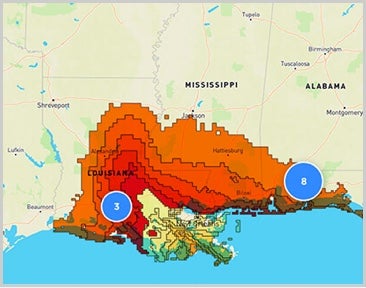

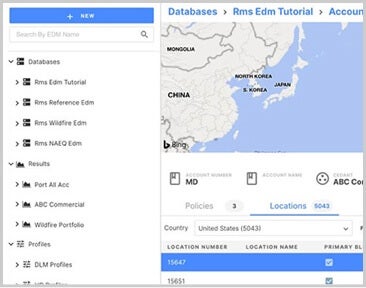

Exposure and Portfolio Management

Experience the future of portfolio management with ExposureIQ.

Learn more

Risk Modeling

Move risk management to the cloud for faster, easier risk insights with Risk Modeler.

Learn more

Intelligent Risk Platform

Accelerate your digital transformation journey with a comprehensive platform.

Learn more

Treaty Analysis

Turn underwriting expertise into superior pricing and returns with TreatyIQ.

Learn more

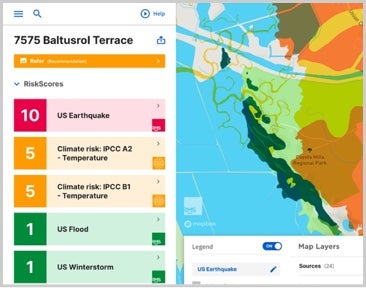

Assess Location Risk in Seconds

Reduce underwriting overhead and make more informed decisions faster than ever.

Learn more

Climate Change

Increase resilience, improve governance, and make better business planning decisions, by operationalizing climate change analytics.

Learn more

Learn more about UnderwriteIQ