Summer has just started, but weather has already been warm over Europe. Many countries have experienced very high temperatures over the first weeks of June, and there is a chance the 2014 summer will be warmer than normal. A warm atmosphere can bring very high convection potential and potentially lead to a busy severe convective storm season. While seasonal forecasts are uncertain, severe hail events already experienced in June already point to a potential increase in hail risk this year.

The first noticeable hailstorm of the season hit Germany, France, and Belgium between June 7 and 9. Over that period, southern air masses were very warm and clashed with much cooler air from the north. This frontal system brought heavy local wind, rain, and hail, especially over the north of France, Belgium, and northwest region Germany, where large cities like Essen, Düsseldorf, or Köln experienced property damages and six casualties.

RMS scientists Dr. Navin Peiris and Panagiotis Rentzos led a reconnaissance survey in the region a few days after the event and noted that even if there was some evidence of direct hail damage to roofing, most of the substantial damages and transport disruption around Düsseldorf came from tree falls due to very strong wind gusts.

July 12, 2014 will be the 30th anniversary of the most expensive hailstorm in the history of Germany, which generated losses around US$2 billion 1984—half of which was insured. The hailstorm developed amid a streak of late afternoon thunderstorms after a day of intense solar heating. A mass of moist sea air flowed into southern Germany overnight and the combination of moisture and rising air triggered a rapidly intensifying thunderstorm system over the Swiss Mittelland that propagated eastward. Hail fell within a 250-kilometer (150-mile) long and 5–15 kilometer (3–9 mile) wide swath from Lake Constance to eastern Bavaria near the Austrian border. At around 8 p.m. local time, the hailstorm passed over Munich, damaging approximately 70,000 houses, 200,000 cars, 150 aircraft, and most agricultural crops within the storm’s path. More than 400 people were injured. Over half of the insured losses were attributed to damaged cars.

July also marks the first anniversary of the 2013 German hailstorm, which caused insured losses of US$3.4 billion, the second highest from a single natural catastrophe in 2013. Like the June 2014 events, the storm hit after a prolonged period of above-average temperatures in central Europe. The first hail event hit northern Germany on July 27, and the second dropped hailstones with a diameter of up to 8 cm (3.1 in) over south Germany the next day.

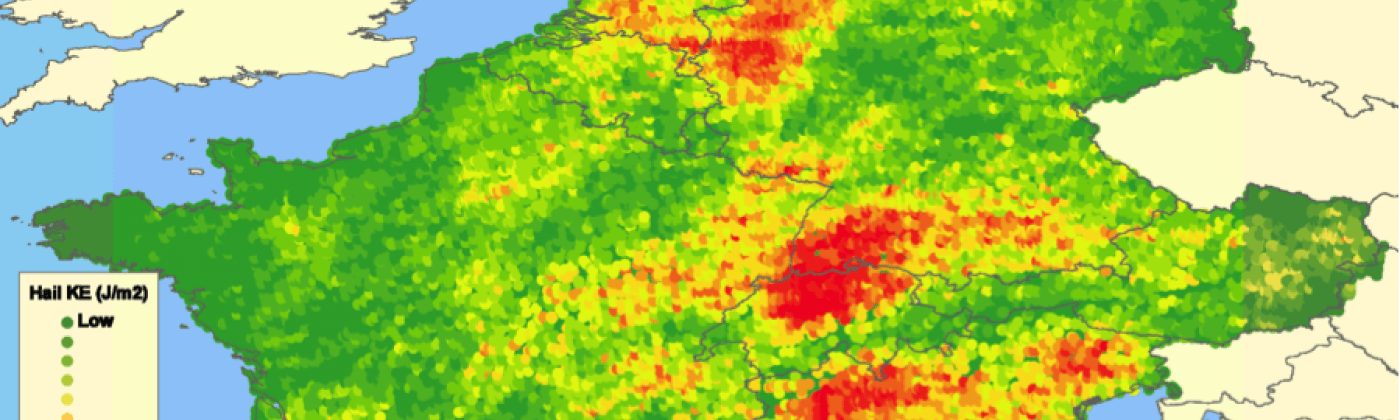

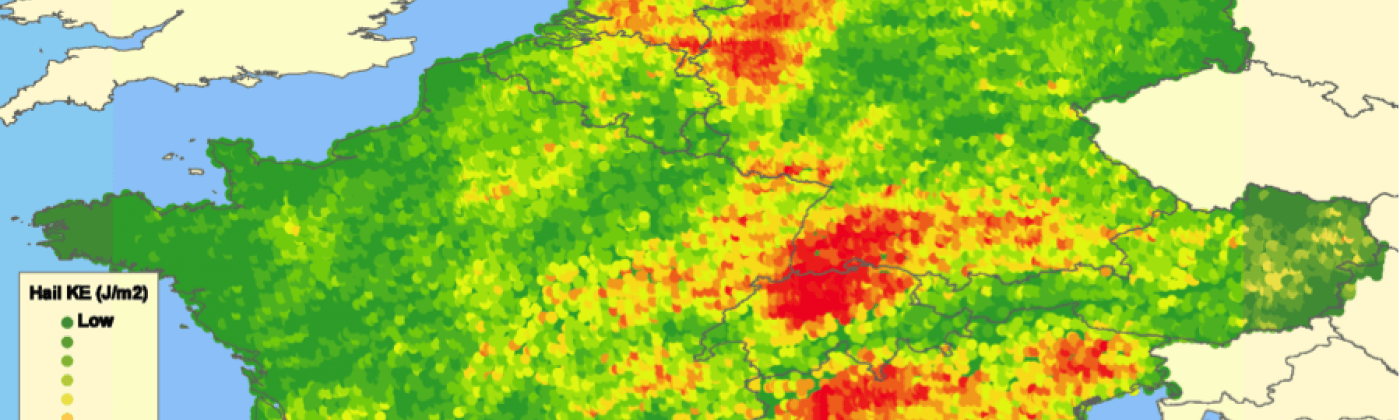

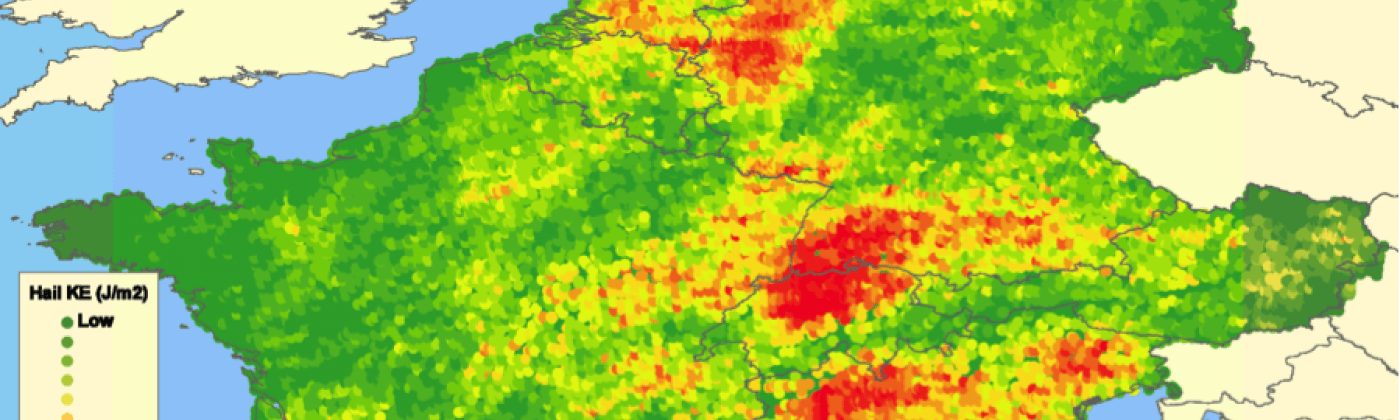

Interestingly, all these major events occurred in regions with very high potential of hail damage, which can be described in catastrophe models such as the RMS HailCalc model in terms of kinetic energy to help better manage hail risk. In June, RMS presented the first results of a reconstruction of this hailstorm on at the 1st European Hail Workshop. The paper illustrates how a fast estimation of insured hail losses could be obtained following an event in the future. Developing methods of estimating insured loss totals and return periods immediately after an event are an ongoing area of research in the insurance industry, as illustrated in the RMS paper and others at the workshop.