The Goal

A New Approach to Cyber

Gallagher Re and Moody’s RMS™ have a closely aligned philosophy in modeling catastrophic cyber risk. Through this collaboration, the global reinsurance broker is leveraging a sophisticated actuarial approach to help its clients measure and price the underlying risk and grow their business.

As a young reinsurance broker on the block and unencumbered with legacy systems, Gallagher Re (rebranded after the acquisition of start-up Capsicum Re in 2020) immediately sought to differentiate itself from its peers through a sophisticated, analytics-led cyber offering.

“Cyber is in our DNA,” explains Justyna Pikinska, head of specialty analytics at Gallagher Re, “and we believe an analytics-led approach is key to the market’s development.”

Gallagher Re was the first to coin the acronym ‘PC&C – Property, Casualty & Cyber’, acknowledging that cyber is developing as a class of business in its own right, does not sit comfortably within the traditional insurance buckets, and is expected in time to be as large as property and casualty lines.

Gallagher Re also recognized early on that better data and analytics were essential in order for the market to grow, particularly in measuring the potential aggregation risk from systemic tail events such as a ‘wormable’ ransomware event or a cloud service provider failure.

The Objective

Extending an Actuarial Approach

Gallagher Re is much more than just a placement broker. It uses a dedicated team of actuaries and cyber professionals, while investing in an ecosystem of tools and models, to build robust capabilities to quantify cyber re/insurance hazard and exposure.

With its ‘cyber centre of excellence’ consultancy practice sitting alongside its specialist analytics and actuarial team, the reinsurance broker builds its own models and accumulation tools, working with clients on everything from pricing and security to reserving and assessing tail risk.

"Cyber is in our DNA, and we believe an analytics-led approach is key to the market’s development."

Justyna Pikinska,

Head of Specialty Analytics, Gallagher Re

“Knowledge is key and we’re really keen to share our deep expertise with our clients,” says Pikinska. “We use standard actuarial methods in our approach, but tailor them to the unique features of cyber which sets us apart as a team.”

Cyber risk is a very different beast to natural catastrophe risk, and needs to be treated as such when designing an analytics approach. First and foremost, it is a relatively new peril and most carriers do not have a huge wealth of claims data to fall back on. Second, and more crucially from a modeling and analytics perspective, it is a manmade exposure which is constantly changing and evolving.

Ransomware is one example. Whereas threat actors initially took a scattergun approach, cybercriminal gangs are now being more targeted, tailoring ransom demands to the size of the organization. Through increasingly common double extortion attacks – where threat actors extort for data exfiltration in addition to encryption – gangs seek to extract as much payment as possible, thus increasing the overall severity of loss.

It is on the potential for systemic losses and the need to better assess risk in the tail that Pikinska’s team is focusing signficant attention, developing model frameworks for ransomware and cloud downtime risk among other things. Unlike other classes of business, the more the cyber re/insurance market grows, the more challenging and complex the risk landscape becomes.

There is aggregate risk potential. The WannaCry and NotPetya attacks of 2017 were an initial taster of the global impact such events could have. More recently, the Kaseya supply chain ransomware attack has again highlighted the catastrophic potential for ‘supply chain’ attacks, whilst the HolesWarm Cryptominer malware campaign demonstrates that vulnerability attacks are not purely limited to single points of failure.

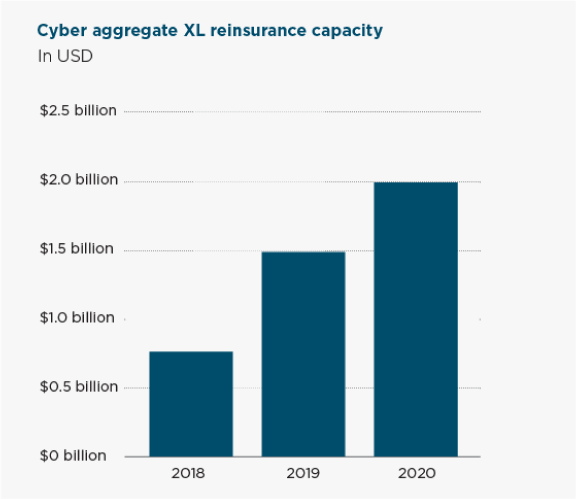

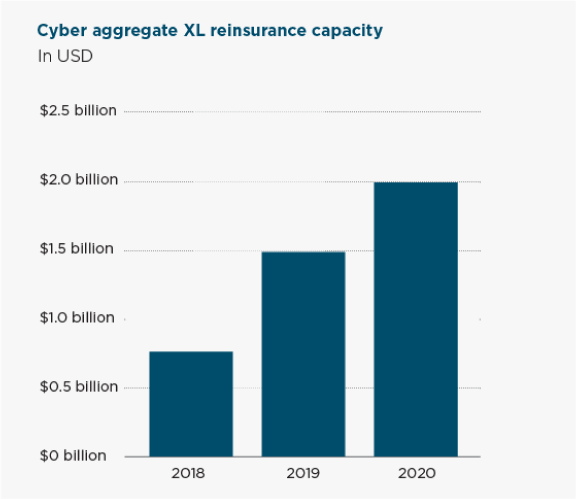

As Swiss Re reflects in a recent blog, concern around aggregation risk is reflected in the steady growth of reinsurance purchases. Its data shows the total limit of aggregate excess of loss cyber reinsurance placed (excluding retrocession) increasing from $1.5 billion to $2 billion between 2019 to 2020. It follows a 100% increase between 2018 and 2019.

The Solution

Unpicking the Tail

The Moody’s RMS Cyber Solution has uniquely considered these elements in its modelling of the cyber risk landscape.

Drawing on its relationship with Moody’s RMS, Gallagher Re has made significant strides in its understanding of tail risk events, sharing this insight with their clients as the market seeks to fulfill its potential. Gallagher Re considers Moody’s RMS a strategic partner, with both entities closely aligned on their view of risk.

“We research the challenge ahead, which could be a cloud downtime event,” says Pikinska. “With a manmade peril like cyber, the more the market grows the more systemic tail risk becomes a bigger issue. Everyone is extremely keen to solve this puzzle when it comes to tail risk quantification.”

The Process

Close Collaboration at Every Stage

The team worked closely throughout the Moody’s RMS cyber model on-boarding process, explains Moody’s RMS director of cyber product management Matt Harrison. “Cyber models are still in their early days of development. When you get to the size of natural catastrophe, there is years of history and resource, but in cyber we are all quite new to it and taking the steps we take – and having close collaboration with our partners – gives it the most value.”

The knowledge and experience brought by Harrison and his team were critical to the relationship, from Pikinska’s perspective. With his background running cyber modeling at a large Lloyd’s player, Harrison has a strong understanding of the market data needs of cyber re/insurance underwriters.

It is still a developing class for many insurance carriers. They may have catastrophe model functions with highly skilled teams that have backgrounds in earth and climate science, but there is sometimes little ownership for cyber – making it even more important to partner with a cyber-specialist reinsurance broker.

Unlike natural catastrophe risk, the newness of cyber risk means it has not always had a clear home; many carriers are now building centers of excellence for underwriting, pricing and accumulation control, but these functions are often relatively immature. While at other carriers, the modeling of this risk can still fall between the cracks of different functions.

“So when these individuals go and talk to a team like Gallagher, it makes a big difference to them,” says Harrison.

The Outcome

Growing the Market

Premium rates within the cyber re/insurance market have been hardening over the last two years, as carriers have been stung by a growing frequency and severity of claims. Taking an analytics approach to cyber risk has never been more crucial, helping attract new capital to the arena.

Resolving some of the uncertainty surrounding the potential catastrophe load is the key to offering end-clients a more sustainable product and larger insurance buyers the program limits they require.

Having worked on the market’s first cyber ILS solution, Gallagher Re is keen to support new entrants and encourage the growth of capacity in both the reinsurance sector and capital markets going forward.

“Many re/insurers are just beginning in the cyber modeling space - plenty of teams are just two to three years old,” says Harrison. “Teams like Gallagher Re have been doing it for twice as long and, therefore, they are one of the most analytically influential intermediaries out there.”

“The reinsurance market has more wariness around the potential for volatility, and the work Gallagher is doing as a reinsurance broker is integral to getting the message across that there are sophisticated frameworks for understanding tail events.”

“Models help to improve capital certainty and ultimately that is good for clients. Bringing in more capital is key to a bigger cyber insurance market which is a positive thing.”

© 2023 Risk Management Solutions, Inc. and/or its affiliates and licensors (“Moody’s RMS”). All rights reserved. All names, logos, and icons identifying Moody’s RMS and/or its products and services are trademarks of Risk Management Solutions, Inc. and/or its licensors or affiliates. Third-party trademarks referenced herein are the property of their respective owners.

Risk Management Solutions, Inc. is a subsidiary of Moody’s Corporation (NYSE: MCO) and operates as part of the Moody’s Analytics business segment. Moody’s Analytics is operationally and legally separate from the Moody’s Investors Service credit rating agency.

Gallagher Re is a full-service global reinsurance broker owned by Gallagher, one of the world’s largest insurance brokerage, risk management and consulting firms. Founded in 2013 as the co-venture ‘Capsicum Re’ with Gallagher, the business became the primary treaty reinsurance outlet for the Gallagher group of companies and has grown rapidly to become the world’s 5th largest reinsurance broker with a team of more than 160 people. On 1 October 2020 the business rebranded to Gallagher Re, to complete its integration into the global firm (NYSE: AJG), having become its wholly owned specialist reinsurance arm in January 2020, and to fully align the reinsurance business with Gallagher’s retail and wholesale insurance broking operations around the world. Based out of key global reinsurance hubs — in London, Bermuda, Rio de Janeiro, Santiago, Miami and New York — Gallagher Re is focused on attracting the best advocates in the market to provide bespoke and specialist reinsurance advice and solutions, and building the foremost broking teams in its chosen areas of the market. With the US being the largest reinsurance market globally, accounting for 60% of total reinsurance premium, significant expansion of the business’ US presence is a core priority for its next phase of growth. For more information see www.gallagherre.com