Key Takeaways

- A single, consistent source of data company-wide

- Real-time portfolio views and reporting

- Enhanced portfolio and accumulation management capabilities

- Data roll-ups in seconds rather than days

- Automated data conversion across various entities

- A flexible, open, customizable software platform

- Zero hardware and upgrade management

The Challenge – Optimizing the Data Environment

A Top 10 global reinsurance company operating a proprietary model framework wanted to fully optimize its data environment.

Multiple pain points included the fact that cedant data was received in several formats, requiring considerable resources and time to standardize for model consumption. Also, the current range of exposure management tools across different divisions was preventing a more harmonized and connected data ecosystem.

The reinsurers exposure data platform lacked the open framework and level of system transparency needed to align it fully with their unique data and modeling requirements.

The Solution – Introduction of Risk Modeler 2.0 And ExposureIQ

The solution was to create a more fluid, dynamic, and unified data environment. Automated data standardization and an integrated exposure management tool was needed to achieve that, spanning all business functions, built upon an open and transparent software platform.

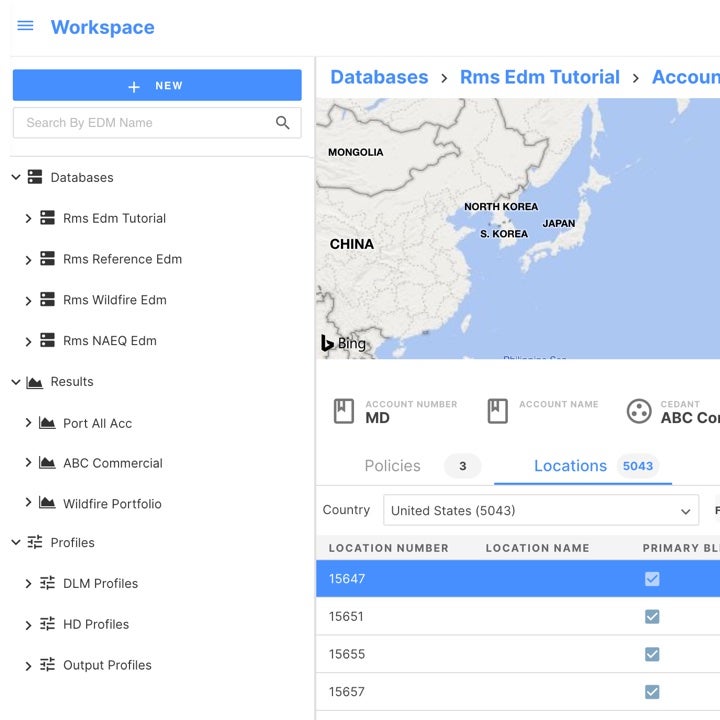

The adoption of Risk Modeler 2.0, and ExposureIQ™ provided a consistent exposure management tool across the organization, ensuring data consistency at every link in the chain through risk management and portfolio management processes. ExposureIQ provided automated data reformatting, saving time and removing the need for each entity to convert client data to other formats.

ExposureIQ provided an improved performance on spider accumulations the reinsurer needed to run on cedant portfolios across the different business units. The highly visual mapping capabilities that integrate both accumulation and RMS Event Response provided clear timely insights into the overall portfolio.

The Outcome – A Fully Connected, Automated Data Ecosystem

The adoption of ExposureIQ and ongoing integration of Risk Modeler has helped create a fully harmonized data environment that is built upon a single view of risk and now enables on-demand data analysis.

A single operating system across all divisions has reduced portfolio roll-up times from days to seconds. Data aggregation on a region-by-region is available in real-time, allowing for ‘always-on’ risk accumulation monitoring.

Key advantages for the reinsurance company include more effective and efficient portfolio optimization, instant reporting capabilities, more precise allocation of risk capital, and ultimately, faster, better decision-making.

The SaaS-based application delivers further savings by removing hardware maintenance requirements and supporting system updates in a fraction of the time with zero operational disruption. Furthermore, the open framework offers the ability to customize the software to best align with the reinsurer’s model ecosystem.