The overall insurance protection gap in the U.S. is large, and earthquake risk in California contributes the most to that gap. Between 2010-2019, US$102 billion, or around 19 percent of the US$535 billion in total global earthquake losses were covered by insurance.

While earthquakes were not a driver of natural catastrophe loss in the U.S. during this decade, it is widely recognized if and when a major California earthquake happens, the amount of uninsured loss will be very significant.

With the memory of the 1994 Northridge earthquake nearly three decades into the distant past, earthquakes feel less relevant today to some residents than devastating wildfires or recent significant floods throughout the state.

Despite the general public awareness of the state’s high seismic risk, few California homeowners carry earthquake insurance today.

The California Earthquake Authority (CEA) is one of the world’s largest providers of residential earthquake insurance and has been at the forefront of scientific research in earthquake hazard and seismic performance of buildings in California, funding research programs at the cross-section of academia and industry.

The goal of the CEA is to empower and incentivize California homeowners to mitigate their earthquake risk, provide earthquake insurance for customers of CEA’s participating insurers, and create a more resilient marketplace for the management of earthquake risk.

Some of the key research programs funded by CEA include the Uniform California Earthquake Rupture Forecast Version 3 (UCERF3) model, a core component of the 2014 and 2019 U.S. National Seismic Hazard Mapping Projects.

The CEA also supports various Pacific Earthquake Engineering Research (PEER) projects aimed at employing recent technologies to understand the seismic performance of buildings.

Moody’s RMS® has partnered with CEA on several such research and development initiatives throughout the years.

The CEA recently funded a PEER project to model and document the seismic performance of wood frame houses with cripple wall and sill anchorage deficiencies and the retrofitted conditions that address these deficiencies.

A cripple wall is a short wood stud wall that sits between the foundation and the first floor of the house. A stem wall is another type of common raised foundation type consisting of a concrete wall that runs along the perimeter of the home to support the exterior walls and floor.

The deficiencies, such as insufficient bracing and anchoring of homes to their foundations, represent a major cause of earthquake damage in older wood frame homes built over crawl spaces.

The CEA also commissioned a study for Moody's RMS to understand the appropriate credits and penalties for different foundation types and conditions from an insurance risk perspective.

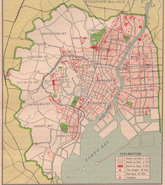

We investigated 48 building variants published by PEER where the different building variants were common to each of four different test locations in California: San Francisco, Northridge, San Bernardino, and Bakersfield.

The building variants considered eight combinations of building superstructure characteristics including the year built, number of stories, and exterior finish.

In addition, six combinations of foundation types, including two-foot (0.6 meter) cripple walls, six-foot (1.8 meter) cripple walls, and stem walls in their retrofitted and unretrofitted conditions, were considered.

Our study suggests that the credits for bracing and bolting can be quantified and potentially passed on to the California residential insurance market, with wider implications for closing the California earthquake protection gap.

Major findings from this report include:

- The reduction in average annual losses for retrofitting wood siding homes on cripple walls was as high as 70 percent, much larger than for retrofitting those same homes on stem walls where loss reductions were as high as 35 percent.

- Retrofitting had a smaller impact on the losses sustained by houses with stucco, particularly for those on cripple walls where reductions in average annual losses were less than 40 percent.

- Bracing and bolting were effective in reducing earthquake risk regardless of the location in California.

- The trends and relative impacts were similar when using ground-up average annual loss (AAL) and ground-up 250-year return period losses.

The Earthquake Brace + Bolt Program (EBB) had provided grants to more than 20,000 homeowners as of May 2023, to successfully complete a code-compliant retrofit of their crawlspace.

Further details about our study can be found in this case study and white paper.

The EBB program has now closed, but to find out more information about the Earthquake Brace and Bolt program, visit here.