From our numerous client conversations, climate change as a business issue has risen high on the agenda, and this has certainly escalated over the last twelve months. There is a growing recognition of the need to quantify the impact that climate change will have on your business. But – where do you start with this? One of the major challenges is knowing what question to ask. With the inclusion of climate change scenarios within the General Insurance Stress Test (GIST 2019), which the larger U.K. insurers and Lloyd’s syndicates are required to respond to, the Bank of England Prudential Regulation Authority (PRA) is outlining one approach.

RMS is particularly well placed to support insurers in responding to the “Assumptions to Assess the Impact on an Insurer’s Liabilities” portion of the climate change section within GIST, which examines how changes in U.S. hurricane and U.K. weather risk under different climate change scenarios may affect losses.

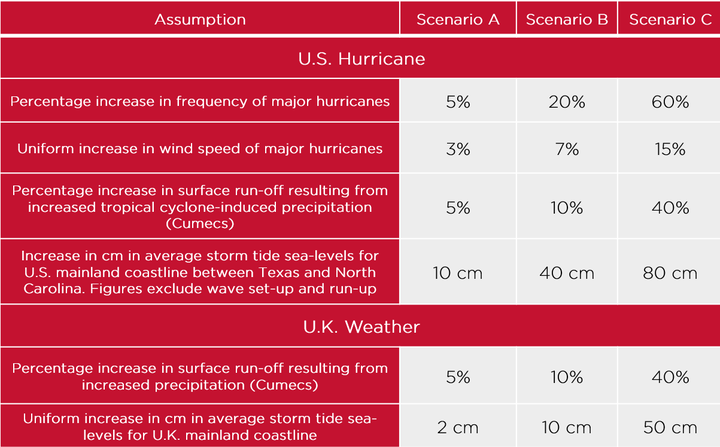

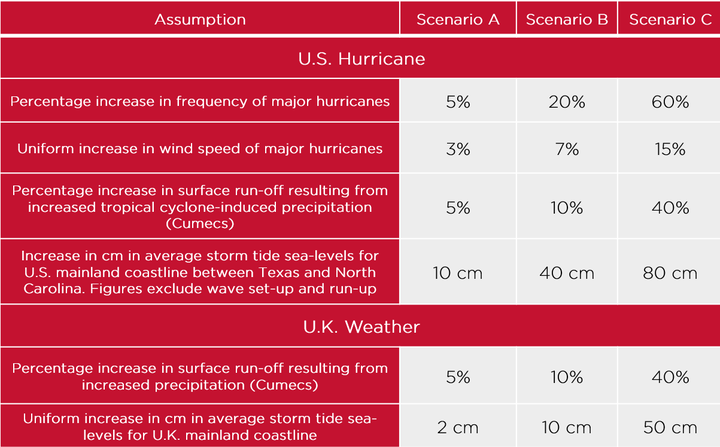

Stochastic models are the perfect tools to evaluate such physical climate change risk to liabilities, with the ability to reflect changes to the hazard under different climate change views and providing a clear link between cause and effect. Our contribution to the landmark “Risky Business” report in 2014 looking at sea-level rise in the U.S. to 2100 is a key example of this. As such, RMS has developed internally adjusted views of its U.S. hurricane, U.S. flood, U.K. windstorm and U.K. flood models to reflect most of the assumptions and scenarios from the PRA, detailed in the table below:

The PRA is asking for the potential impact of these assumptions and scenarios on the Annual Average Loss (AAL) and 1-in-100 Aggregate Exceedance Probability (AEP) loss for all relevant U.S. and U.K. insurance contracts. Getting to a reasonable assessment of these numbers however is not a trivial exercise, requiring the appropriate adjustment of model data in up to 18 possible assumption scenario combinations, and then the analyses of the relevant exposure against these.

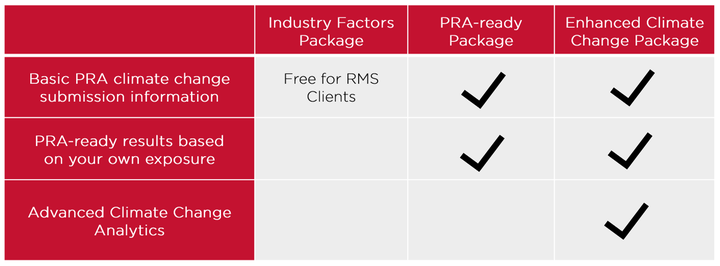

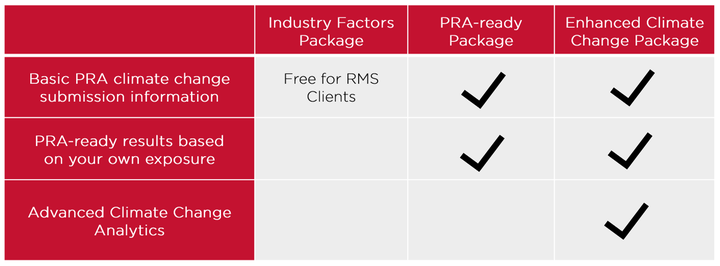

To help insurers start thinking about how to respond to the PRA request, RMS can provide broad industry-wide factors derived by running industry exposure over the adjusted models. This “Industry Factors Package” will be made available to RMS clients, while others who wish to access these will be able to license them separately. The industry-wide factors will allow for the approximation of losses under the assumptions and scenarios laid out in the table above, however there could be significant limitations to this approach for individual companies and portfolios. Your exposure, or risk profile, will not reflect that of the industry and therefore the application of industry-wide factors may not reasonably reflect your own risk. The uncertainty around this approach means you may decide this is not a satisfactory solution for your submission.

For a more detailed bespoke view, we are offering to run insurers’ own exposures through the adjusted models, via RMS Analytical Services, to better satisfy the PRA’s requirements. This “PRA-ready Package” provides unique results for submission to the PRA which reflect your book of business and allow for comparisons with those of the industry.

Even if you fall out of the larger U.K. insurers and Lloyd’s syndicates for whom this applies, you should take note. This might be the start of a new wave of analytical rigor around climate change, and more regulators are likely to follow. Beyond regulation, it is also becoming fundamental to understand the impact of climate change for business decisions. For example, to answer what is insurable in 2050 and whether you need to adjust your underwriting and portfolio management strategy accordingly.

RMS can assist in getting answers to such questions through a customized climate change consulting engagement as part of an “Enhanced Climate Change Package”, utilizing advanced climate change analytics to provide more detailed results based on the PRA or other similar scenarios. This package can include the PRA-ready results and basic PRA climate change submission information or be a separate engagement depending upon your needs.

RMS clients who are interested in these solutions should reach out to their Client Success Manager for details on how they can be accessed, while other insurers can email sales@rms.com. With the submission date of October 31 looming, and many with tighter internal deadlines, it is important not to delay! Indeed, we are already engaging with several clients on how we can help them.