Tag: parametric insurance

Filter by:

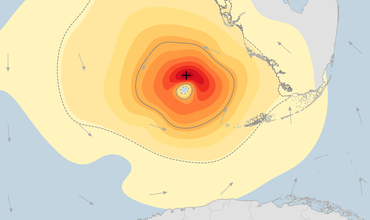

Moody’s RMS HWind: How to Reduce Basis Risk When...

When a catastrophic event such as a hurricane occurs, it can have a significant and wide-ranging impact on a region. Away from the tragedy of…

Unpacking Basis Risk

When catastrophe strikes, it is not unusual for the insurance payout to differ from the policyholder’s expectation. The possibility of such a…

The Role of Catastrophe Risk Finance in Developi...

We all know that prevention is better than cure. Trouble is, sometimes you catch a cold. And if you’re already vulnerable, a relatively small…

Subscribe to Our Newsletter