Commentary in the specialist insurance press has generally deemed pricing of catastrophe bonds in 2015 to have bottomed out. While true in average terms, baseline pricing figures mask risk-return values. True risk pricing can be calculated only by considering all dimensions of loss, including seasonal variations and the time value of money. New analysis by RMS does just that, and shows that cat bond pricing has actually been higher in 2015 than it was last year.

Pricing of individual cat bonds is based largely on the expected loss—the average amount of principal an investor can expect to lose in the year ahead. Risk modelers calculate the expected loss for each deal as part of the transaction structuring, but to obtain a market-wide view based on consistent assumptions, we first applied the same model across all transactions to calculate the average expected loss.

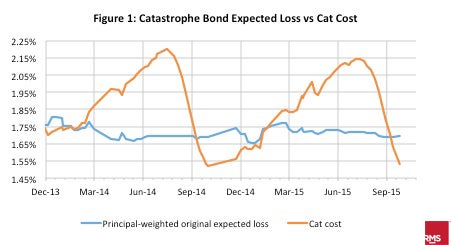

Care must be taken as all loss is not equal, a fact reflected in the secondary-market pricing of catastrophe bonds. Because of the time value of money, a loss six months from now is preferable to a loss today: you can invest the money you are yet to lose, and collect coupons in the meantime. We have calculated the time-valued expected loss across more than 130 issuances in the secondary markets, which we have called Cat Cost. It is dramatically different than unadjusted values, as shown in Figure 1.

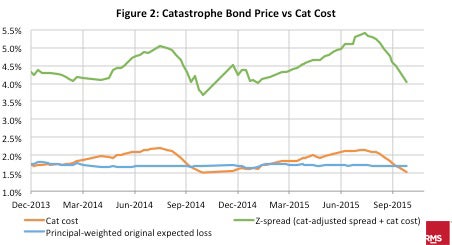

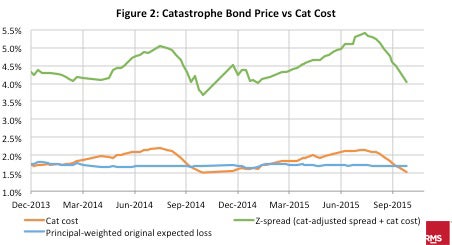

The next step to reveal the true level of cat bond pricing involves accounting for secondary market pricing quotes. Figure 2 plots the same Cat Cost data as Figure 1, but now includes pricing quotes of the bonds, which we gleaned from Swiss Re’s weekly pricing sheets. Also plotted is the “Z-spread”—this is the spread earned if all future cash flows are paid in full and the metric is calculated using a proprietary cash flow model which determines future cash flows (floating and fixed), and discounts back to the current market price. The difference between the two—the space between the top and bottom lines—is the Cat-Adjusted Spread, which measures the expected catastrophe risk-adjusted return.

We can see clearly that on 30 September, 2014 the Cat Cost was 1.53%, identical to the Cat Cost on the same day in 2015. However, this year’s cat-adjusted spread for that day is 2.52%, compared to 2.22% for 2014. In other words, the pricing of cat bonds at the end of the third quarter of 2015 was thirty basis points higher than it was on the same date in in 2014, relative to the risk and adjusted for the time value of money.

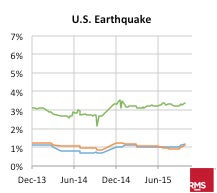

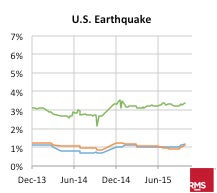

The astute will have noticed that the bond spread rises each year as the hurricane season approaches, and falls as it wanes. To account for this seasonal pricing effect, and to reveal the underlying changes in market pricing, we have split the analysis between bonds covering U.S. hurricanes and those covering U.S. earthquakes.

The findings are plotted in Figure 3, and the picture is again dramatic. It is clear that the price of non-seasonal earthquake bonds is relatively static, while hurricane bond prices rise and fall based on the time of year.

This analysis further shows—for both hurricane and earthquake bonds—that spreads were higher this year than last, relative to adjusted risk. Steep drops in excess returns masked roughly static end-of-year returns in the cat bond market, rather than reflecting a risk-based price decline. Despite the prevailing commentary, the catastrophe bond market is returning markedly more to investors today than it did a year ago, when it bottomed out. But only accurate risk and return modeling reveals the true rewards.

This post is co-authored by Oliver Withers and Jinal Shah, CFA.