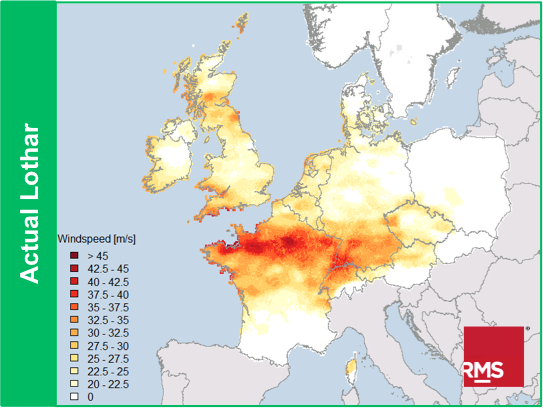

While wind speed can indicate a storm’s damageability, two storms with similar peak wind speeds can cause vastly different levels of damage if they pass over locations with different concentrations of exposure.

This month marks the 15th anniversary of Lothar and Martin. Two powerful storms that tracked violently across Europe on December 26-28, 1999.

The combined European loss of both storms is in excess of $11 billion (2013 values). Since the storms occurred within days of each other it’s difficult to calculate the exact split of damage, however a 70:30 ratio is commonly accepted, ranking Lothar as the second largest Europe windstorm loss on record after Daria (1990).

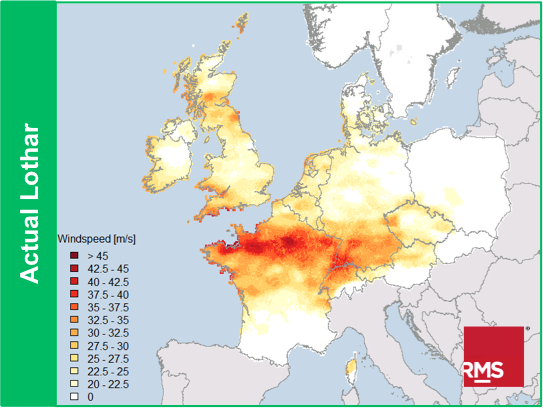

France was hit hardest by the storms—particularly Paris, which was right in the bullseye of Lothar’s most extreme physical characteristics. The recorded wind speeds in the low-lying regions of Paris were above 160 km/h and as high as 200 km/h at the top of the Eiffel Tower.

An exceptional storm

While Lothar’s wind speeds are comparable to other historical Europe windstorms, it’s considered an exceptional event for the insurance industry because of its track and the timing of its maximum intensification over Paris. Today, Lothar is a key benchmark used by the industry to understand the potential magnitude of Europe windstorm losses.

Lothar – a one-off for France?

Many industry experts believe Lothar to be higher than a 100-year return period loss event for France; however this should be interpreted as a long-term average and France could potentially experience a similarly extreme storm this winter.

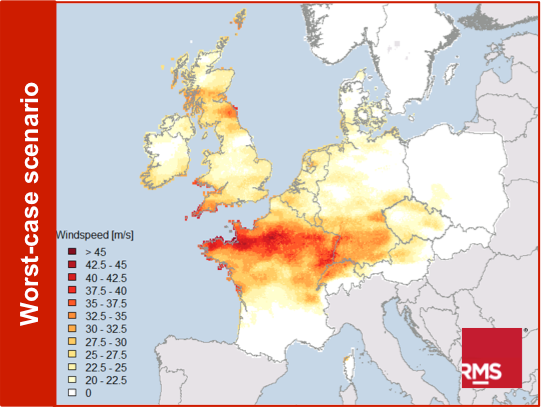

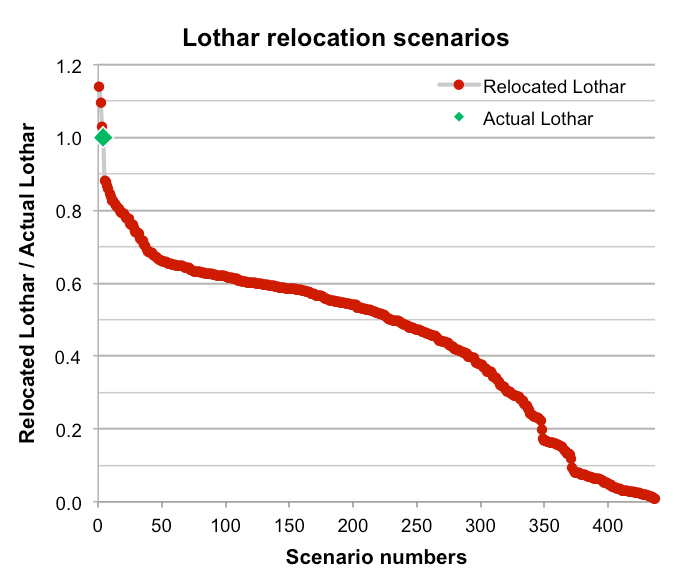

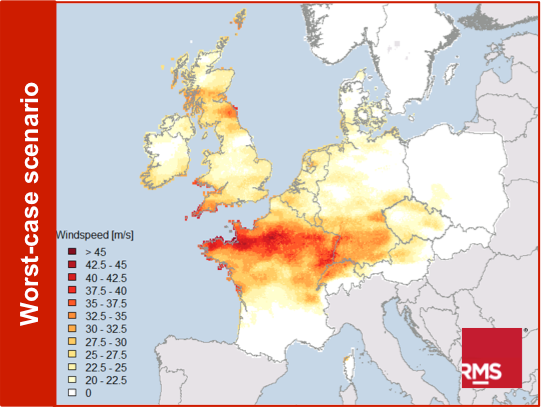

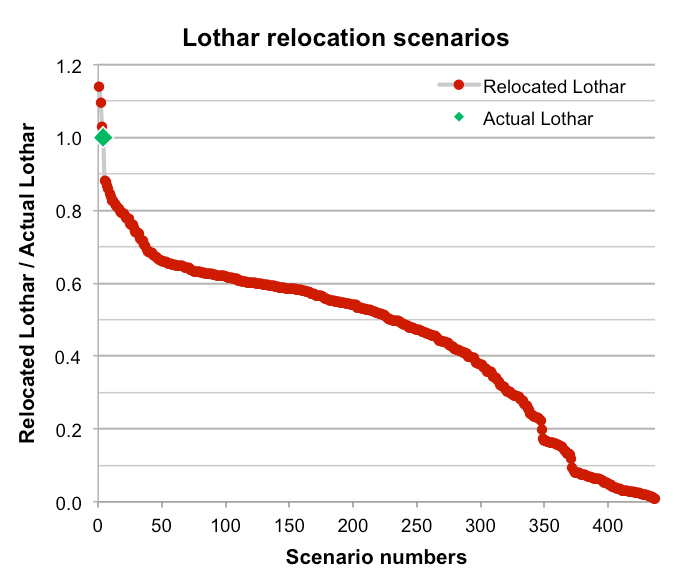

Using current industry exposures, RMS calculated the potential French losses that would result from a Lothar-like storm striking different locations in France. By relocating Lothar’s peak gusts along points up to 500 km in each direction from their original location, our modelers concluded that Lothar was the fourth worst-case storm that could have happened out of a total of 437 scenarios.

The worst-case scenario for France is a Lothar-like storm relocated approximately 100 km west of the original event but which would still significantly impact Paris. The losses from this scenario are not much higher than Lothar’s. At only 15 percent higher the small increase in loss reinforces Lothar as an exceptional benchmark for the insurance industry.

We found that the majority of scenarios in the study produced notably lower losses. This is because the displacement of the storm, by even small distances, meant that the most extreme wind speeds impacted much lower concentrations of insured exposures. The study reinforces our understanding of the sensitivity of windstorm loss to a storm’s path. It also highlights the importance of using a stochastic model containing tens of thousands of events to be able to comprehensively evaluate potential windstorm losses.

London at risk

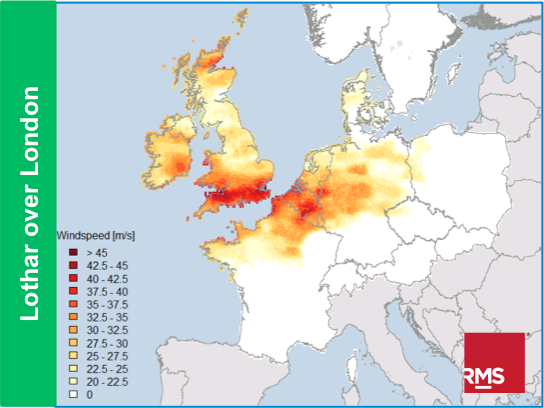

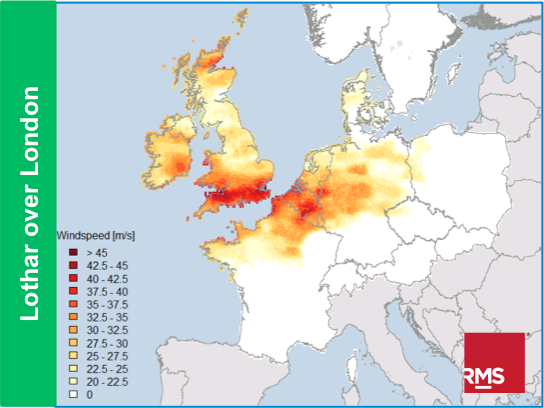

No European city is immune from damaging windstorms. RMS also re-located Lothar over London—only a 350 km shift to the north—to see what the impacts would be. We calculated the insured loss for Europe could be as much as 25 percent higher than Lothar’s losses and potentially bigger than the $8.6 billion loss caused by Daria.

The uncertainty inherent to the climatic phenomena that drive windstorms makes it impossible to forecast exactly when and where the next strong storm will hit France or Europe. However, catastrophe models can at least help to evaluate the potential financial impact of extreme storms like Lothar.