Overview of North America Wildfire Model

Moody's RMS Wildfire modeling accurately characterizes fires as they start and travel due to factors that drive ignition and spread, including wind and presence of vegetation. This helps insurers, reinsurers, governments, and financial institutions differentiate safe structures from dangerous ones, conduct risk assessments, estimate potential losses, accurately price fire risk, and optimize risk transfer.

Improve Portfolio Management

Use Moody's RMS wildfire models to monitor and manage risk accumulation for any portfolio, protecting from insolvency, stress testing potential losses, and identifying growth opportunities in today’s changing wildfire risk landscape.

Leverage Comparative Metrics

Our wildfire analytics provide industry-standard loss metrics similar to those available for other probabilistic models of perils to avoid surprises when looking at CAT bonds.

Protect Your Business

Benchmark your business, calculate the benefits of mitigation actions, ensure risk differentiation, and understand wider financial implications.

Changing the Wildfire Analytics Game

The North America Wildfire Model quantifies the location and severity of wildfire risk beyond simple techniques for better understanding of impacts.

Gain a Single View of Risk With Wildfire Risk Modeling

Regional and Country Wildfire Models

Regional Models

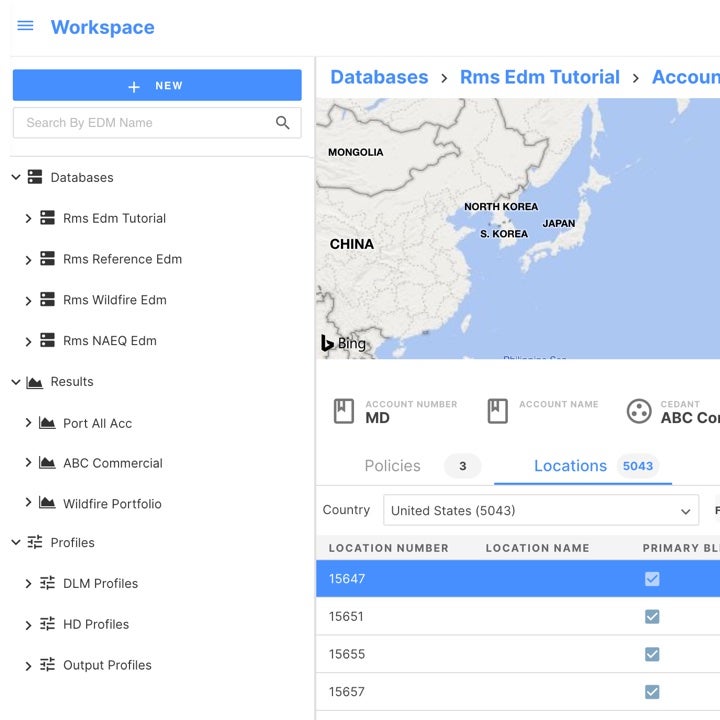

Click a region on the interactive map to see coverage.

Related Products

The Moody's RMS wildfire model and related data are included in several Moodys' RMS products – each tailored to serve different use cases.

Resources

U.S. Wildfire: Calculating the Value of Mitigation Benefit...

The hallmarks of climate change – such as prolonged drought, record high temperatures, or even increased rainfall – have helped accelerate wildfire risk in California and other western states in North America. Each wildfire season now tracks well above average. According to CAL FIRE, the 2021 California wildfire season was 58 percent above the five-year average in terms of acres burned; the 2020 season was more than two and a half times higher than the five-year average. Eight out of ten of the largest fires...

Canada Wildfire: Managing the Next Fort McMurray

On May 1, 2016, a small wildfire was spotted some 4 miles (7 kilometers) southwest of Fort McMurray. With a population of around 66,000, Fort McMurray is renowned in Canada as an oil production center, located within the vast Athabasca oil sands across northeastern Alberta. An estimated 1.7 trillion barrels (equivalent) of bitumen lie under 54,000 square miles (140,000 square kilometers) of forest and peat bog. Firefighters on the scene quickly acted to suppress the fire, but it reached Fort McMurray two day...

RMS Releases U.S. Wildfire High-Definition Model To Empowe...

NEWARK, CA – February 14, 2019 – RMS®, the world’s leading risk modeling and analytics firm, announces the release of the RMS U.S. Wildfire High Definition (HD) Model, the most comprehensive solution available for addressing wildfire risk across the Contiguous United States (48 States). Since 2014, devastating wildfires have unleashed more than USD $30 billion in claims and five of the 10 most destructive wildfires ever have occurred in the 2017 and 2018 seasons. Severe wildfires have become more prevalent and r...

Wildfire Ignition and Spread

Moody's RMS U.S. Wildfire HD Model captures the full spectrum of complex threat.

New Ways of Modeling Property-Liability Clash and Uncoveri...

Natural disasters and other large catastrophes can trigger huge economic losses potentially among multiple insurance lines. RMS, in collaboration with research partner Cambridge Centre for Risk Studies at University of Cambridge, have developed eight template scenarios that model liability clash triggered by natural or man-made catastrophic events. This research was primarily focused on property–liability clash modeling and was the continuation of the two-year Global Exposure Accumulation and Clash (GEAC) pro...