Tag: RMS U.S. Inland Flood Model

Filter by:

Urbanization Under Pressure: Recent Flood Events...

During an average September, New York City (NYC) gets 4.3 inches (110 millimeters) of rain for the entire month. In just a few hours during…

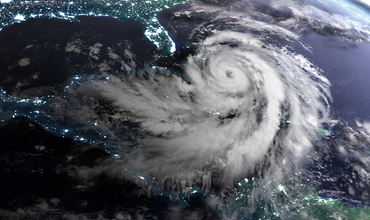

Moody’s RMS North Atlantic Hurricane Models: Fiv...

,

,

Earlier in 2023, Moody’s RMS® released a new version (Version 23) of its North Atlantic Hurricane (NAHU) Models. This model suite was released…

From Record Heat to Record Rainfall: Tropical St...

California and the dry desert states of Arizona and Nevada are used to breaking temperature records. It was only in July that Phoenix,…

Introducing Moody's RMS Version 23: Now Available

A major new version of Moody’s RMS RiskLink®, RiskBrowser®, and related products was made generally available on June 14, 2023. The new…

What Did We Learn from the California Flooding?

From soaring temperatures, drought, and wildfires in 2022, then floods, mudslides, and snow just into 2023, the western U.S., and particularly…

RMS Expands Climate Change Model Suite to Includ...

Just under a year ago, RMS® announced the first RMS Climate Change Models for North Atlantic hurricane, Europe flood, and Europe windstorm.…