Tag: insurance-linked securities

Filter by:

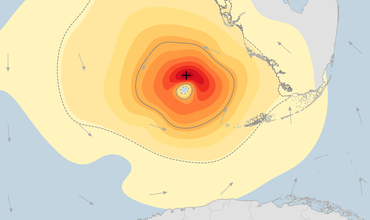

Moody’s RMS HWind: How to Reduce Basis Risk When...

When a catastrophic event such as a hurricane occurs, it can have a significant and wide-ranging impact on a region. Away from the tragedy of…

Advancing the Use of Humanitarian Cat Bonds

In the U.K., as part of the New Year Honours List for 2022, David Peppiatt, director of humanitarian assistance at the British Red Cross, was…

Insurance-Linked Securities: Demonstrating Resil...

Despite being a relatively new asset class, the insurance-linked securities (ILS) market has had its fair share of milestones when it comes to…

Defining an Analytics Strategy to Scale Your Bus...

It is a constant challenge for any fast-growing business to ensure that their systems and processes continually evolve, to improve efficiency…

What Are the Technology Drivers of ILS Growth?

On February 1, I had the opportunity to speak at a panel session entitled “Technology as a Driver for ILS Growth” at the Artemis ILS…

The Sum of Its Parts: Wildfire in Multi-Peril Ca...

Water, wind, and wildfire. It’s been a devastating three months for the U.S. Total insured losses from Hurricanes Florence and Michael, and…