Which of the following would you say has the shortest odds?

a) Someone getting injured by a firework

b) A meteor landing on a house

c) Someone being struck by lightening

d) A tsunami striking east coast of Japan

e) A person being on a plane with a drunken pilot

Disturbingly option e) has the shortest odds at 117 to 1 but you may be surprised to hear that option d) is next, the earthquake that led to the 2011 Japan tsunami had an annual probability of approximately 600 to 1 (other odds; a. 19.5K to 1; b. 182T to 1; c. 576K to 1).

Tsunamis can be devastating when they occur, as we saw when the Indian Ocean tsunami hit in 2004 and more recently with the Tohoku, Japan tsunami in 2011. But before these events, tsunami risk wasn’t high on many (re)insurers agendas.

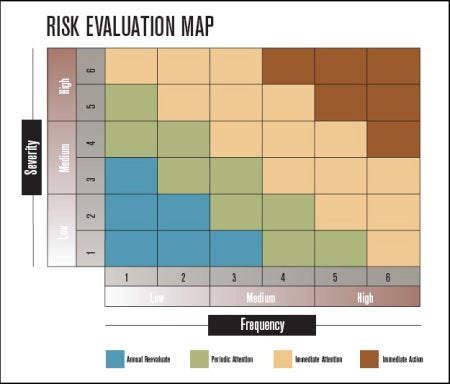

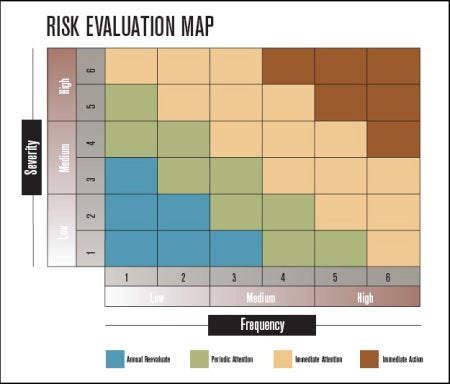

It’s one of those risks that many would place in the upper left green section of the frequency / severity risk map below, requiring periodic attention.

The first step in managing risk is to identify and categorize it.

Some other natural catastrophe risks, such as earthquake, fall near this region but generally garner immediate attention. So what made tsunami different?

Tsunamis have a particularly low frequency, especially when only considering events that have impacted developed regions. In addition, limited data availability and complexities associated with modeling this hazard meant that it was a risk that the industry was aware of but didn’t necessarily evaluate.

The lack of data was highlighted by the Tohoku event. An earthquake of the magnitude observed was not anticipated for the subduction zone off the east coast of Japan. The maximum projected earthquake magnitude was 8.3, with accompanying expected tsunami heights not as large as those experienced. Sea walls built along northeast Japan’s coastal towns, such as in Minamisanriku, Miyagi, weren’t designed to protect against the tsunami that occurred.

This devastating event brought tsunami risk into sharp focus but the questions we must now ask are:

- Where will the next tsunami-generating great earthquake be?

- How can we manage this risk?

An interesting conundrum surrounding the first question is the number of very large earthquakes that we have observed recently.

Before the 2004 Indian Ocean tsunami, the last earthquake greater than magnitude 8.6 occurred 40 years earlier (1965’s Mw 8.7 Rat Islands, Alaska Earthquake). However, since 2004 we have observed 5 earthquakes equal to or greater than Mw 8.6. It’s unclear whether we have underestimated the potential for large earthquakes or are just observing a random clustering of large events.

As research continues into the frequency and occurrence of these events, perhaps the best approach is to focus on understanding hazard hot spots. Most devastating tsunamis are generated by earthquakes in subduction zones and incidentally, subduction zones are where most great earthquakes (Mw 8.7+) have been observed.

Since 1900 all observed great earthquakes were generated on shallow subduction zone “megathrust” faults. Therefore it is vital to understand where these earthquakes occur and the potential associated tsunami scenarios.

Looking back to our risk map, risks with this frequency / severity combination may not stop (re)insurers providing cover. However, assessing scenarios will help them understand their tail risk and manage potential accumulations, which may lead to stricter underwriting guidelines and policy terms in high-risk zones.

Typhoon Haiyan recently highlighted the devastation caused by coastal inundation. On this occasion from storm surge, yet the city of Tacloban is vulnerable to tsunamis of greater height, as noted by Robert Muir-Wood in his recent post.

November 25th marked the 180th anniversary of another great earthquake to strike the region of Sumatra, Indonesia; the 1833 event occurred just south of the location of the devastating 2004 earthquake and also caused a significant tsunami.

These events remind us that while tsunami may be an infrequent hazard, coastal inundation can be devastating and these events have occurred in the past and will occur again in the future.

Although the industry may not know when the next event will occur, tools like accumulation scenarios can help (re)insurers explore the risk, understand where their exposure to tsunami is greatest and evaluate how to best to manage it.