Tag: RMS(one)

Filter by:

Welcome to Exceedance 2018

The wait is over, and we are excited to welcome delegates from around the globe to one of our largest-ever Exceedance conferences. We really…

Exceedance 2018: Risk Management. Transformed.

Our sixth Exceedance conference makes a welcome return to Miami, this time at the waterfront InterContinental Hotel on May 14-17, 2018. The…

Hurricane Irma: The Exposure Variable

11:00 UTC Thursday, September 7 Rhett Austell, director – Client Solutions, RMS In the days leading up to landfall for a major hurricane…

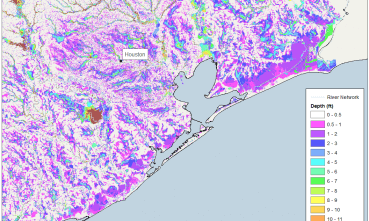

Harvey Shows the Advantage of Cloud Solutions Wh...

Farhana Alarakhiya, vice president – Products, RMS Hurricane Harvey continues to be top of mind at the RMS offices. On Wednesday, RMS hosted…

Data Analytics: Fueling the Future of Insurance

Look around and you see the financial services industry being transformed by a newfound ability to tap into a vast amount of data, right at…

Taking Advantage of Open Vulnerability Modeling

Competing in the insurance market through differentiation, and demonstrating knowledge and expertise to a client, are central to so many…